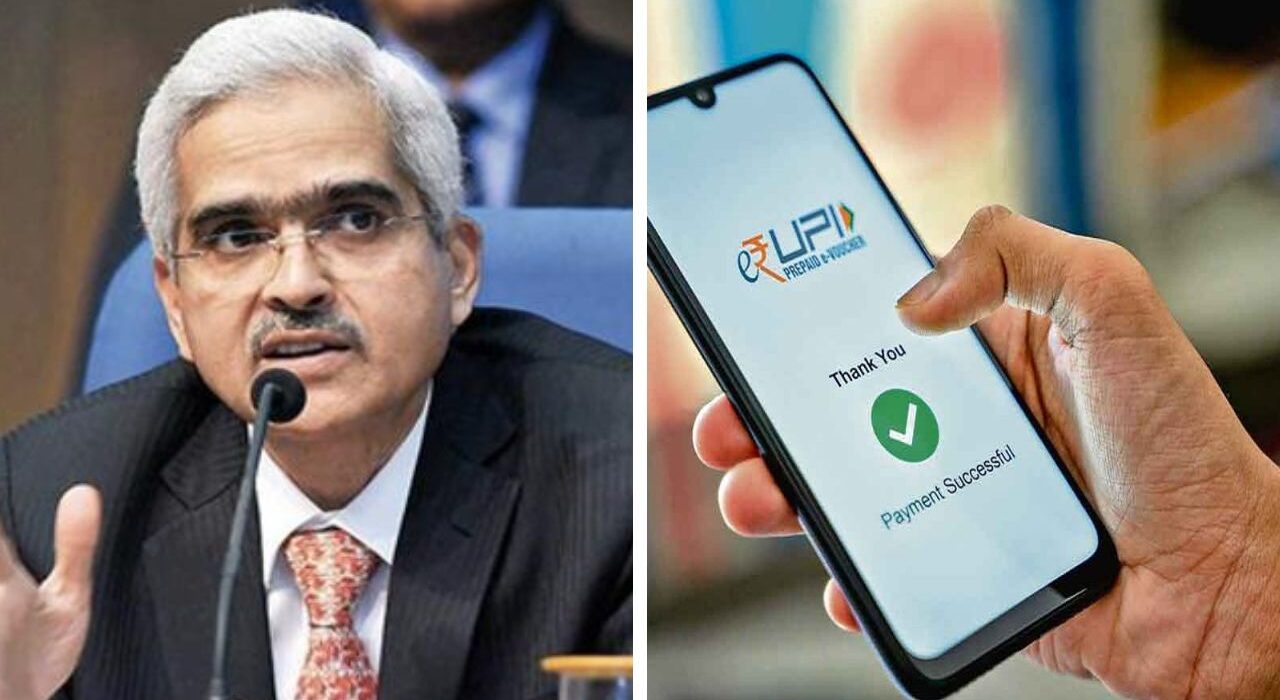

The Reserve Bank of India (RBI) to launch a new platform for quick loans named Unified Lending Interface. Introduced by the RBI governor, Shaktikanta Das, the ULI is set to bring a big change to the entire mechanism of credit disbursal, especially for rural and small borrowers. The new RBI platform for fast loans harnesses the power of advanced digital technology to quicken credit processing and reduce the time used in credit appraisals to facilitate seamless access to loans for both individual consumers and businesses.

The ULI platform is expected to be a game-changer for retail lending, just like UPI was for digital payments. The disintegrated nature of credit appraisal data among various entities made the need to develop this platform urgent. ULI integrates all kinds of data into an open-architecture, open-API platform for seamless lending on the lender and borrower sides. It shall allow a plug-and-play connection to be made with financial institutions, further reducing the technical integration burden. Speaking at its launch, Das was quoted as saying by ANI:

“Just like UPI transformed the payments ecosystem, we expect that ULI will play a similar role in transforming the lending space in India. The ‘new trinity’ of JAM-UPI-ULI will be a revolutionary step forward in India’s digital infrastructure journey,”

🚨BIG: After round-the-globe success of UPI, RBI is set to launch a new platform for credit named ULI (Unified Lending Interface).

— The Analyzer (News Updates🗞️) (@Indian_Analyzer) August 27, 2024

This will reduce the burden of extensive documentation & will provide quick LOANS to individuals.

JAM (Jan Dhan- Aadhar- Mobile) Trinity 🔥🙌 pic.twitter.com/o48q7r5B0d

The ULI platform leveraged pilot projects initiated in 2022-digitalization of KCC loans, among others, to help bring efficiency into the loan processing ecosystem. The various kinds of loans supported on the platform include but are not limited to KCC loans, MSME loans, personal loans, and home loans as of 31st March. With this pilot, 12 banks took part and were linked with 31 different data sources. The platform aims at providing faster loan disbursal times by enabling digital lenders with data from as wide a variety of information sources as land records and financial histories.

The new platform that RBI launch for instant loans will thus be focusing more on agriculture and the MSME sectors, which have a huge unmet demand for credit. The consent-based data sharing on the platform with different attributes of privacy protection aligns with the objective of India’s digital public infrastructure. By utilizing JAM Trinity and UPI, the ULI extends a revolutionizing digital experience whereby consumers can get frictionless credit tailored to their needs without any need for paper documentation.

The ULI platform is in readiness for its scaleup to amplify its reach, managed by the Reserve Bank Innovation Hub, for multiple stakeholders in the financial sector. More data would be unlocked from gig platforms and payment systems, further enhancing its ability to make fast loans. This potential to cut down the time in processing loans critically makes the Quick Loans Platform from RBI place India among global leaders in this nascent market for digital lending. In the times to come, the platform may be overseen by entities like NPCI while it assures more and more growth and innovation in the financial sector.

Notably, Das also highlighted the success of UPI saying, “The current ecosystem of digital payments in India offers a bouquet of simple, safe, and secure options for instant or quick transfer of funds, both large and small value, for businesses and individuals,”.

Also Read: Who Is The Richest Cricketer Of India Who Is Far Ahead Of Virat Kohli And Sachin Tendulkar