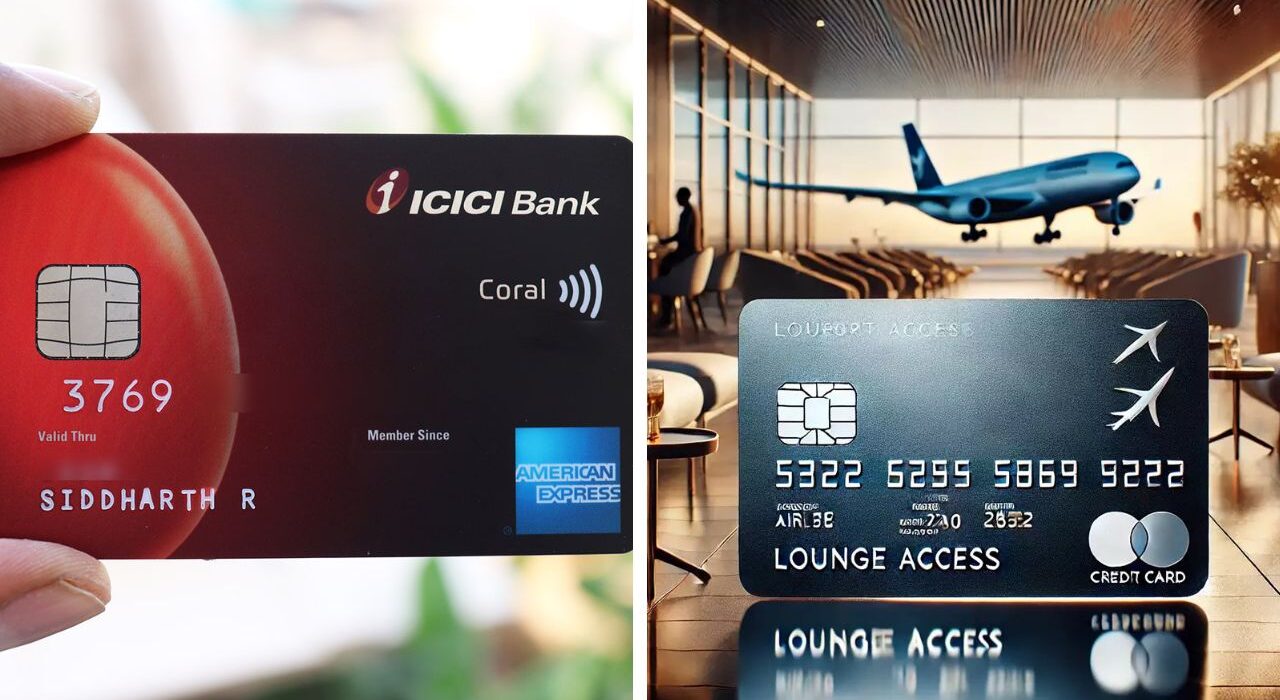

The credit card policies of ICICI Bank have seen some major changes from 15 November 2024. However, one of the policies is receiving massive backlash for a significant hike in price. According to the latest update, the airport lounge access requirement has not only increased but has doubled up directly for use in an airport lounge.

The amount has increased from Rs 35,000 to Rs 75,000 in a quarter as a calendar-based requirement. Several credit cards of ICICI Bank, such as HPCL Super Saver Visa, Coral Credit Card, Rubyx Visa, and Sapphiro Visa, have seen these policies.

The airport lounge access requirement increases based on the spending in the previous quarter. Additionally, there are caps on rewards. Premium card holders will earn rewards on monthly spends up to Rs 80,000 and standard card holders have a much lower cap of Rs 40,000.

Airport lounge access requirement doubled: ICIC caps rewards on spending

This has increased the need to log in to the airport lounge, and ICICI Bank has also capped the rewards on grocery and departmental store spending. Premium cards have a cap of Rs 40,000, the other cards are capped up to Rs 20,000 in this space. Another such move has come with the abolition of spa services at airports for the Sapphiro Visa and Emeralde Credit Cards.

This amendment has also levied an annual charge of Rs 199 for the supplement cards. Besides, this amendment introduces a few more changes, such as a 1% bill payment charge levied on bills like utility bills above Rs 50,000 and educational payments through third-party apps like CRED and Paytm.

It can be seen that the hike in the requirement of airport lounge access with such amendments depicts how ICICI Bank is trying to refine the benefits and work according to the spending habits of its customers.