The festive rush has had platforms offering the convenience of delivering gold and silver coins in minutes. However, multiple customers claim to have fallen prey to the Blinkit gold coin scam. They allege that they were provided with a coin of lower weight than the one ordered.

Many customers took it to social media and revealed that they had ordered a one-gram gold coin. To their surprise, the company delivered to them a coin with 0.5 grams of gold. Social media users paid ₹ 9,253 to Malabar Gold & Diamonds for ordering a coin of 1 gram and 10 gm of silver.

Blinkit gold coin scam: Company fails to provide customer support

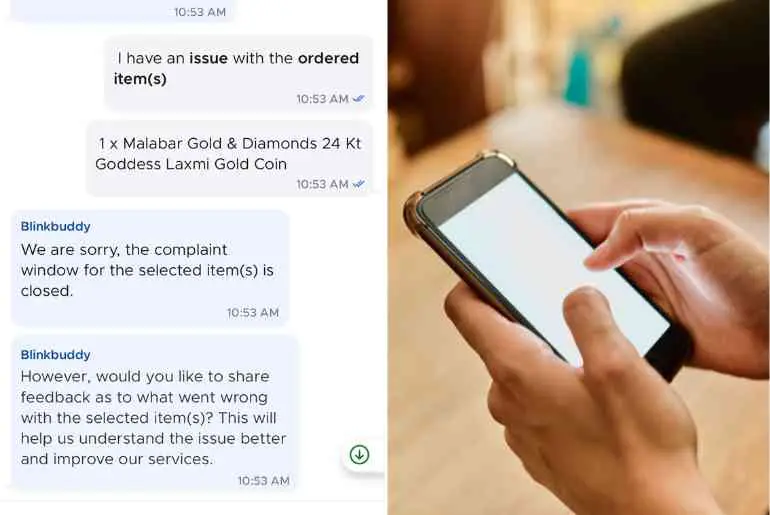

As per users’ posts, since some of them were not present at home during delivery, the package reached their family members. Later, they came to know that the delivery was made at the wrong place and hurried to contact the support team of Blinkit. They could not lodge any complaint with customer service as the window for the complaints opened only 20 minutes after the delivery time.

Then, users shared some screenshots taken of a conversation between them and Blinkit support, narrating their experience as well as how the delivery person could not provide any more assistance.

Customers share complaints on social media

Many customers posted their complaints about the scam on Blinkit on social media, which prompted the company to reach out to them to address the issue. The business assured them of support but did not clarify whether they would get a full refund or an exchange for the correct coin.

The Blinkit gold coin scam is trending on most online media platforms, and a huge number of users participated by bringing up similar issues experienced when making quick-commerce. Several were in disbelief, while some shared their unpleasant experiences while using Blinkit’s service. The whole episode led several users to reassess their decision to buy products from Blinkit in bulk.

As e-commerce gets hotter, quality control and responsiveness in servicing consumers are at the forefront of anxieties in purchasing such high-value items like gold.

Also, see: India’s gold demand in 2024 hits all-time low due to rising prices