- Impact of the US Presidential elections on the price of Bitcoin (BTC-USD) and on other digital currency market.

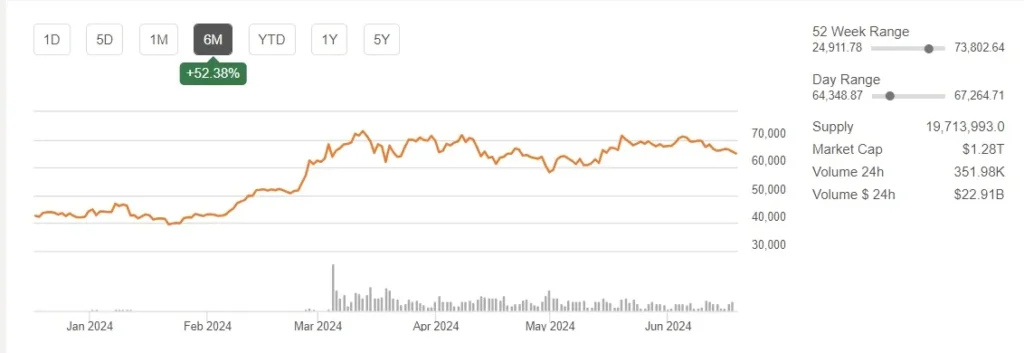

- Talking about the leading cryptos, price of Bitcoin (BTC-USD) increased ~52.38% and Ethereum (ETH-USD) has been up by over 50% in just 6 months

- In cryptocurrencies market, the number of users should amount to 992.50 million by the end of 2028.

- User penetration of crypto users is expected to be ~13.88% in 2024, and this should hit ~15.88% by end of 2028.

Impact on Bitcoin of US Presidential Elections

Impact of the US Presidential on the price of Bitcoin (BTC-USD) and on digital currency market remains a question on the minds of global investors. With the presidential elections approaching on 5th November 2024, Bitcoin’s (BTC-USD) price is expected to significantly fluctuate due to political and economic activities.

Before knowing the impact on Bitcoin (BTC-USD) of US Presidential Elections, it is important to note that the US (which has been tagged as a global financial superpower) has a strong role to play in shaping financial trends globally. Since start of the year, price of Bitcoin (BTC-USD) has surged over ~45%. This can be because of the speculations that Mr. Trump might become the US President yet again.

According to standard chartered, Bitcoin may reach to $150,000 if Donald trumps wins the elections.

Not only the digital currency market, the result of the elections will also significantly impact the stocks and bond markets.

Trump administration told crypto backers that they should vote for him. This is because of the way the current President unleashed regulatory crackdown on overall crypto industry.

In this article, we will see the impact on Bitcoin (BTC-USD) of US Presidential Elections and how this digital currency is being perceived by Democrats and Republicans. With expectation of higher user base in cryptos, I believe that politicians who will support the crypto industry are likely to win the US Presidential elections 2024.

Read Also: PSU bank share which is likely to announce dividend: Should you own?

What has history suggested?

The Presidential elections in US take place once in every 4 years. To better understand impact on Bitcoin (BTC-USD) of US Presidential Elections, let us see how the past elections have impacted the Bitcoin’s price.

In 2012, Barack Obama was re-elected as President of the country. At that time, Bitcoin’s (BTC-USD) price was quite low, at ~$10.90. However, after one year of his re-election, its price went up by ~2,221% and moved over $250. That being said, experts are of the view that Mr. Obama had no direct influence on this exceptional surge.

When Mr. Donald Trump was chosen as the US President in 2016, price of Bitcoin (BTC-USD) went up by ~3.8%. However, market believed that this marginal and short-term increase was mainly because of the uncertainty related to Trump’s victory.

This shocked the overall equity market, leading to higher demand for safe-haven assets, with Bitcoin (BTC-USD) being considered as one. Global hedge fund managers believed that, if Trump wins, it will lead to a crisis-like situation and investors should turn to Bitcoin (BTC-USD) as it is a defensive asset.

Stances which have been adopted by the US presidential candidates about digital currencies might potentially result in increased momentum in crypto market. Americans tend to prefer candidates supporting Bitcoin (BTC-USD) and other digital currencies in the Presidential elections.

Future US presidential support for Bitcoin (BTC-USD), along with several other digital currencies, might encourage other countries to accept cryptocurrencies. This, in turn, might strengthen crypto industry and might also turn it into attractive prospect for global investors.

Performance of cryptos and industry outlook

Increase in crypto market over past few days was because of several factors driving renewed investor optimism and increased interest in digital assets. As a result of these factors, Bitcoin (BTC-USD) went up by ~52.38% over the past 6 months. Apart from these, approval of Bitcoin Spot Exchange Traded Funds (ETFs) by the U.S. SEC has fuelled investors’ sentiments. Following is the graphical representation of BTC’s price:

Ethereum’s (ETH-USD) stability and favourable developments in the crypto landscape helped its price increase. This has contributed to traders’ expectation of further price appreciation, which drove optimism in the market. Price of Ethereum (ETH-USD) increased by over 50% over the past 6 months.

Following is the graphical presentation of ETH’s price:

Other cryptos have also seen price appreciation. Binance Coin (BNB) saw a strong increase of ~140.5% in just 6 months, while price of Solana (SOL-USD) went up from just $21.98 (13th July 2023) to $134.64 (as on 18th June 2024).

Talking about outlook, recent surge in cryptocurrency prices exhibits promising future for overall crypto market. As of now, the global cryptocurrency market cap stands at ~$2.44 trillion, as per Forbes. As per Statista, revenue in the cryptocurrencies market is anticipated to touch US$51.5bn by the end of 2024. Over 2024-2028, its revenues are expected to be compounded at ~8.62%, which should result in projected total amount of US$71.7 billion by 2028.

Read Also: Top 3 Growing Industries Offer Great Investment Opportunities

US Presidential Elections or Bitcoin (BTC-USD) Election?

In July 2023, Larry Fink (BlackRock’s CEO), mentioned that Bitcoin is expected to transcend every international currency as a result of broad-based global demand. If his views become true, Bitcoin (BTC-USD) will not be just a sidenote for government officials and decision makers. Bitcoin (BTC-USD) will be a matter of national securityfor the US.

Facts and expectations of global analysts seem to exhibit that this digital currency will be relevant to the US Presidential 2024 elections than ever before. This fact is supported by the recent trends also. Some of the political candidates have started to share positions on Bitcoin (BTC-USD) and crypto.

Per the recent article by CoinDesk, 1 in every 3 US voters mentioned that they will give weightage to the political candidate’s position on cryptocurrencies before they make their decision to vote.

While these 33% are more interested, online survey of over ~1,700 people demonstrated that ~77% of the respondents mentioned that US presidential candidate is expected to have an “informed perspective” on cryptos and digital currency.

Global experts are of the view that American voters from different political spectrum exhibit increased interest in making investments in crypto assets. These voters are likely to support candidates who are well-versed with emerging and dynamic technologies.

How Bitcoin (BTC-USD) was treated by Biden administration?

In analysing the impact on Bitcoin (BTC-USD) of US Presidential Elections, it is important to discuss how the current Biden administration is treating this digital currency. Over previous 4 years, President Joe Biden exhibited a clear reluctance to support Bitcoin and digital currency industry. On May 31, Biden used his veto power for a critical bill that would have enabled highly trusted financial institutions to custody Bitcoin (BTC-USD) along with several other cryptocurrencies.

This bill further focuses on integrating Bitcoin (BTC-USD) into mainstream financial system. This will be done by offering a regulatory framework which will allow banks and other financial institutions to securely hold digital assets.

Supporters of this bill believe that such framework will enhance security of spot Bitcoin ETF funds and will promote innovation. Apart from these facts, this bill will also promote development of Bitcoin industry through distributing tokens currently being held by certain institutions.

That being said, Biden’s veto exhibits his administration’s lack of support for overall industry. Earlier also, Mr. President has compared cryptocurrency traders to wealthy tax evaders.

During his term, he even proposed 30% tax on digital currency mining industry. Biden administration’s economic report in 2023 even downplayed challenged the attractiveness of the crypto assets. Report mentioned that several digital currencies appear to be speculative investment tools.

Recently, Joe Biden’s Department of Justice made the arrest of founders of Samourai Wallet, which is a renowned privacy Bitcoin (BTC-USD) mixing service. The founders were charged with money laundering.

Democratic Party reluctant to aid legislation helping Bitcoin

Additionally, Democratic Party is also reluctant to aid legislation helping Bitcoin (BTC-USD). Renowned public figures like Senator Elizabeth Warren have been quite extrovert against the cryptocurrency industry. Warren had criticized cryptocurrencies because of their environmental impact and regulatory challenges. She went on to say that she is building an anti-crypto army. This army will act as shield for the threats to financial stability and consumer protection.

Securities and Exchange Commission Chair, who is a Biden nominee, executed extensive series of enforcement actions against the companies operating in crypto space. He opines that they are flouting federal securities laws.

On the other hand, Trump continues to portray his support for the overall cryptocurrency industry.

Read Also: The Ambani Family Net Worth Reaches 10% of India’s GDP

How Mr. Trump supports cryptocurrency?

Prominent rivals of Biden are Robert F. Kennedy Jr. and Donald Trump. Interestingly, both these competitors expressed their supportive views on overall digital currency market. Backgrounds on such issue offer interesting insights about potential path of overall crypto industry.

Former President, Mr. Donald Trump, has started to embrace Bitcoin (BTC-USD) and world of cryptocurrency. On June 1, 2024, Trump made an announcement that his campaign will accept Bitcoin (BTC-USD) payments through Lightning Network. This is enabled by Bitcoin and Lightning infrastructure provider OpenNode.

Apart from this, Mr. Trump has recently assured that he will make every effort to make sure that Bitcoin (BTC-USD) and other digital currencies are accepted by Americans. It is expected that he will support self-custody rights for 50 million cryptocurrency holders throughout America. He went on to say that he is very positive and open to companies operating in cryptocurrency space.

Dynamic stance of political leaders on Bitcoin (BTC-USD) and other cryptocurrencies makes the base of growing importance of such assets in shaping economic and regulatory policies. For Biden administration, reluctance to accept Bitcoin (BTC-USD) continues to alienate significant segment of voter base.

On the other hand, crypto followers believe that clear regulatory frameworks and mainstream acceptance should be able to help in economic growth, and enable financial inclusion. However, some Americans believe that Biden administration prevents this from happening.

Biden administration and majority of Democrats are in the favour of CBDC (Central Bank Digital Currency) as compared to decentralized cryptocurrency such as Bitcoin. CBDC makes more sense with Biden and Democrats than Bitcoin (BTC-USD). This is because Bitcoin (BTC-USD) is comparatively less appealing as it does not support them in achieving aspiring authoritarian goals.

Conclusion

In understanding the impact on Bitcoin (BTC-USD) of US Presidential Elections, it can be said that role of Bitcoin (BTC-USD) in enabling voter preferences and political strategies continue to be more evident.

With more than 50 million Bitcoin (BTC-USD) and crypto holders residing in the US, decisions of several political leaders about digital assets should play a significant role in upcoming elections. This reflects increased significance of Bitcoin (BTC-USD) in overall economic and political landscape.

Trump’s NFT trading cards saw strong attention in crypto space, with several polls indicating that he is the favourite candidate among Republicans.

On the other hand, even though odds are quite less that Robert F. Kennedy Jr. will surpass Biden, he has provided views which support Bitcoin (BTC-USD) and crypto technologies. His has endorsed Bitcoin (BTC-USD) as a token of democracy and freedom. Apart from this, his recent decision to purchase some Bitcoin (BTC-USD) for children, even further supported his positive views for crypto industry.

Since Bitcoin (BTC-USD) is decentralized, there is no Federal Reserve which can impact money supply. There is no authority which can make decisions that can change potential outcomes. Therefore, Bitcoin (BTC-USD) ecosystem seems to be publicly transparent. Anyone can access this digital currency through accessing internet and can invest in Bitcoin (BTC-USD) protocol.

Interestingly, its technology and overall ethos seems to align with values of a young population. This population is increasingly individualistic, and concerned about money. Therefore, Bitcoin (BTC-USD) might serve American values irrespective of political affiliation.

With Bitcoin’s (BTC-USD) strong prominence and significance of young voter demographic, global investors and analysts will keenly watch how Presidential candidates’ stances on crypto change with time.

Read Also: Stocks which might increase if Donald Trump wins the US election this time!

2 Comments