The GST collection of India in August 2024 is revealed. The Goods and Services Tax (GST) is a comprehensive, multi-stage and destination-based tax which is put on every value addition. It is designed to replace multiple indirect taxes previously imposed by central and state governments thereby simplifying the tax structure. GST is important because it promotes a unified national market. GST streamlines the taxation process and improves the performance of doing business and boosts economic growth.

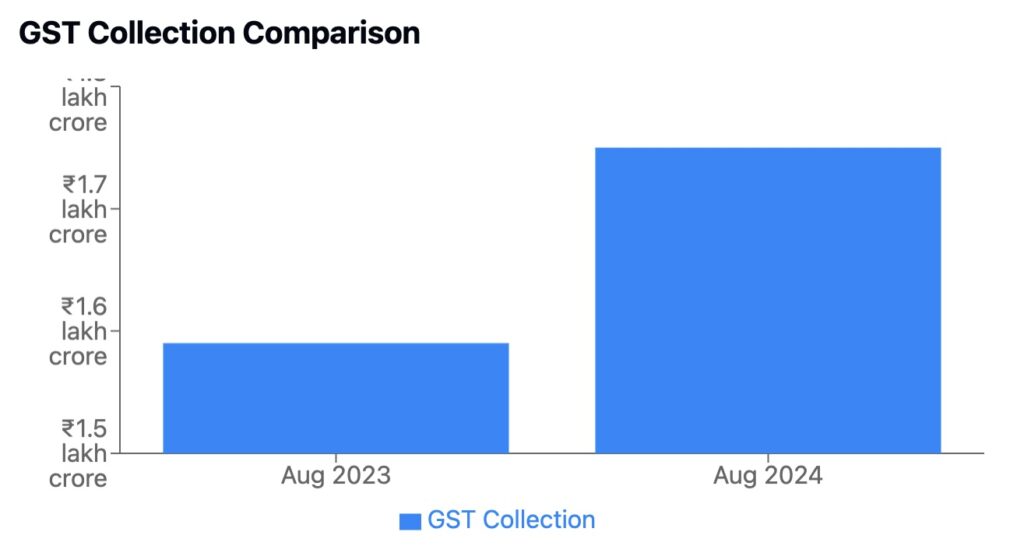

In August 2024 India’s GST collections reached an impressive ₹1.75 lakh crore making a 10% increase compared to the same month last year. This growth is important as it tells the country’s economic power and improved compliance and the GST revenue is an important indicator of economic health showing how businesses are performing and how consumer spending is faring.

The total GST collection includes Central GST (CGST), State GST (SGST), Integrated GST (IGST) and cess and domestic revenue increased by 9.2% amounting to about ₹1.25 lakh crore. The revenue from the import of goods also increased by 12.1% reaching ₹49976 crore. Despite the year-on-year growth the August collection was slightly lower than July’s figure of ₹1.82 lakh crore and this dip is because of various factors including seasonal variations and changes in consumer behavior. However the overall trend remains positive with the average monthly collection standing at ₹1.82 lakh crore.

The statewise GST collections were also revealed by the government for August 2024. The most collection of the GST was from Maharashtra. Manipur and the Andaman and Nicobar Islands had the highest year-over-year growth. Their growth rate exceeded 65% compared to last year while Chandigarh, Ladakh, and Delhi also saw growth as their revenue for August 2023 increased by 27%, 23%, and 22% respectively compared to the previous year.

Maharashtra had ₹26,367 crore followed by Karnataka with ₹12,344 crore and Gujarat with ₹10,344 crore. Tamil Nadu and Haryana also contributed a lot with collections of ₹10181 crore and ₹8623 crore respectively. Uttar Pradesh collected ₹8269 crore while Delhi saw a 22% growth reaching ₹5635 crore.

Also Read: Meet The Man Who Has Made Burj Khalifa With A Net Worth of $5 Billion

Reasons for Growth

The impressive growth in India’s GST collection in August 2024 can be attributed to several factors:

Economic Performance: The increase in GST revenue reflects the country’s economic performance as businesses continue to perform well and consumer spending remains more despite any potential challenges leading to positive GST collection of India in August 2024.

Improved Compliance: The streamlining of the taxation process and the implementation of improved compliance measures have led to enhanced tax compliance contributing to positive GST collection of India in August 2024

Consumption Patterns: The rise in both domestic revenue and import revenue suggests that consumer demand and spending patterns have remained strong supporting the overall economic growth and positive GST collection of India in August 2024.

Policy Initiatives: The government’s ongoing efforts to simplify the tax structure, reduce tax evasion and promote ease of doing business have likely played a role in the positive GST collection of India in August 2024

Also Read: Volkswagen Plans To Stop Production In Germany to Reduce the Manufacturing Cost