Omnichannel eyewear retailer Lenskart had a lacklustre market debut on Monday. Its shares opened below the issue price on both NSE and BSE due to concerns about the company’s share valuation.

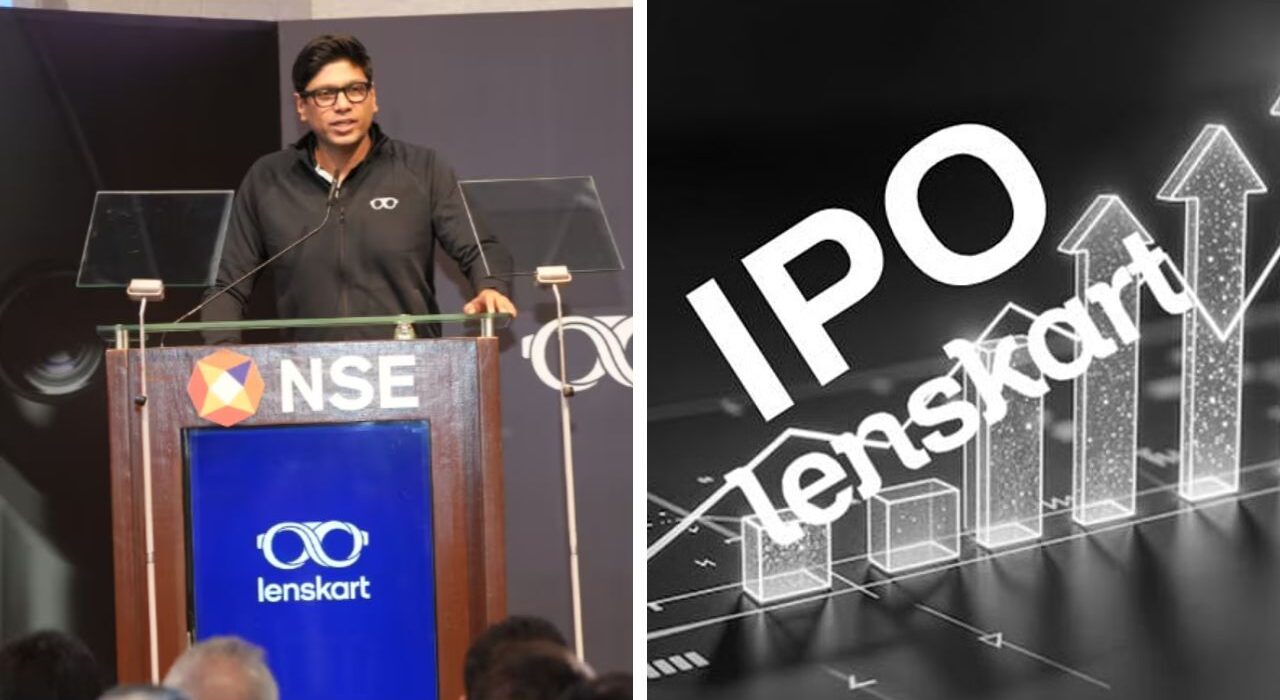

Shares led by Peyush Bansal opened at Rs 395 on the NSE and Rs 390 on the BSE, compared to the issue price of Rs 402. However, shares on the NSE rose in early trading, reaching a high of Rs 404 each.

Lenskart oversubscribed 28 times, weak performance on listing day

Lenskart’s weak performance on its listing day follows a strong demand for its IPO, that oversubscribed 28 times by the final bidding day.

Qualified institutional buyers drove the subscription, oversubscribing their portion by 40 times. Non-institutional investors subscribed 18 times, while retail interest reached 7.53 times the allocated size.

Why investors exit?

Lenskart has joined the growing list of startups that have entered domestic markets as investors seek exits and founders pursue public funding. Last month, Urban Company, led by Abhiraj Singh Bhal, experienced a successful stock market launch, with shares rising over 57% above the IPO price. The company’s Rs 1,900-crore public offering subscribed 103.63 times from September 10 to 12, making it India’s most heavily subscribed share sale of the year, according to Bloomberg estimates.

Read also: Bengaluru Rapido driver touch women legs inappropriately, pulled during ride