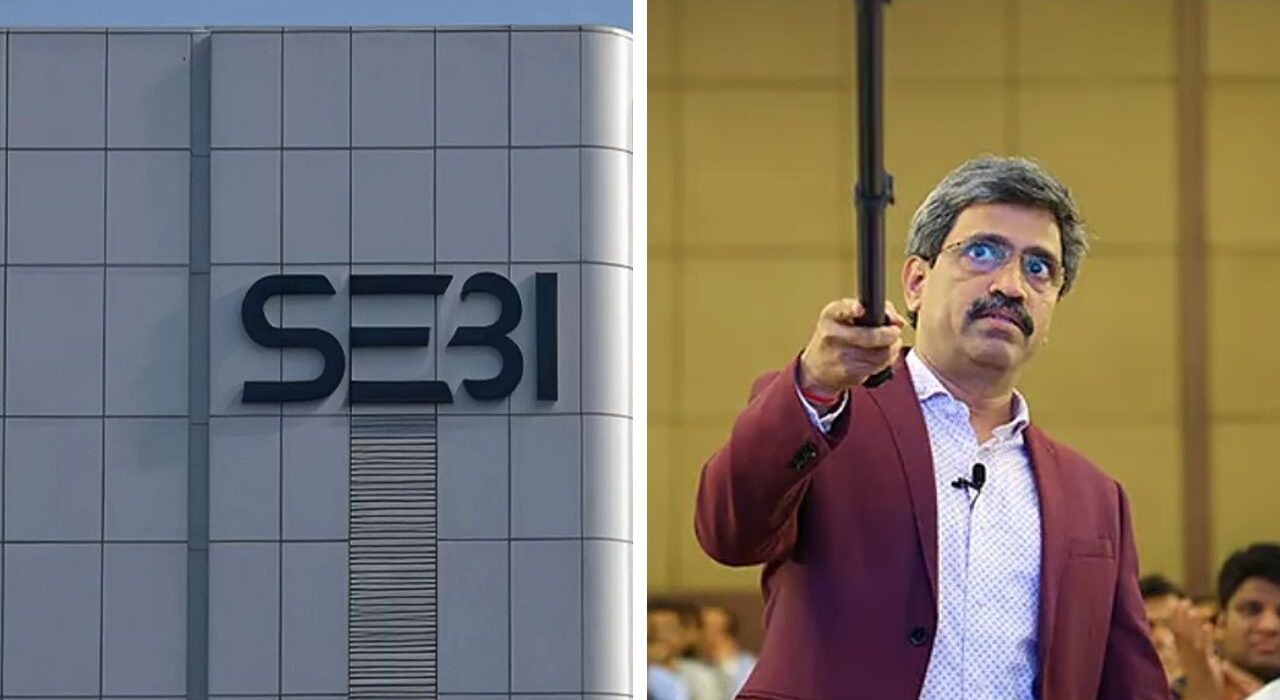

SEBI banned Avadhut Sathe, founder of the Avadhut Sathe Trading Academy (ASTA), from the securities market and has ordered the seizure of Rs 546 crore. The regulator stated this money was raised through unregistered investment advisory activities that misled thousands of retail investors.

The order, issued on December 4, represents a significant step in Sebi’s effort to clean up the finfluencer industry, where many online trainers claim to provide education but often give specific stock tips, advice, and live trading calls without any regulatory license.

How does the case came to SEBI’s attention

Sebi starts investigating after receiving complaints that Sathe’s academy not only offering trading courses but also offers buy and sell recommendations during live market sessions. Once the probe launched, Sebi reviewed videos, WhatsApp messages, social media content, payment structures, and testimonies from participants.

In one example highlighted by Sebi, Sathe seen conducting a live trading session where he directed participants to enter a Bank Nifty futures trade at a certain price, including the stop-loss and target. Sebi noted this went well beyond education and turned into a direct investment recommendation.

Violate the investor protection rules

SEBI discovered that ASTA often promoted high-probability strategies that could “change a trader’s life” and used screenshots of successful trades to market the courses. The regulator argued this created a “false sense of guaranteed returns,” violating investor protection rules.

The order criticized the selective presentation of profits while concealing losses. SEBI said, “The noticees repeatedly displayed only favorable outcomes to prospective clients. This conduct is misleading and intended to induce them to subscribe to the programs.”

Read also: ED attaches assets of Rs 1,120 Crore Linked To Anil Ambani Group in home finance case