The Adani Group planned to make investments an unparalleled USD 15-20 billion throughout numerous sectors over the next 5 years. This investment will drive the next phase of renewable energy growth. It shows a robust financial basis despite ongoing scrutiny.

Adani Group’s various portfolios, spanning from seaports to airports, renewable energy parks to data centers, and cement to gasoline and power, have record sales. The conglomerate committed not just to market success but to contributing to the state’s development.

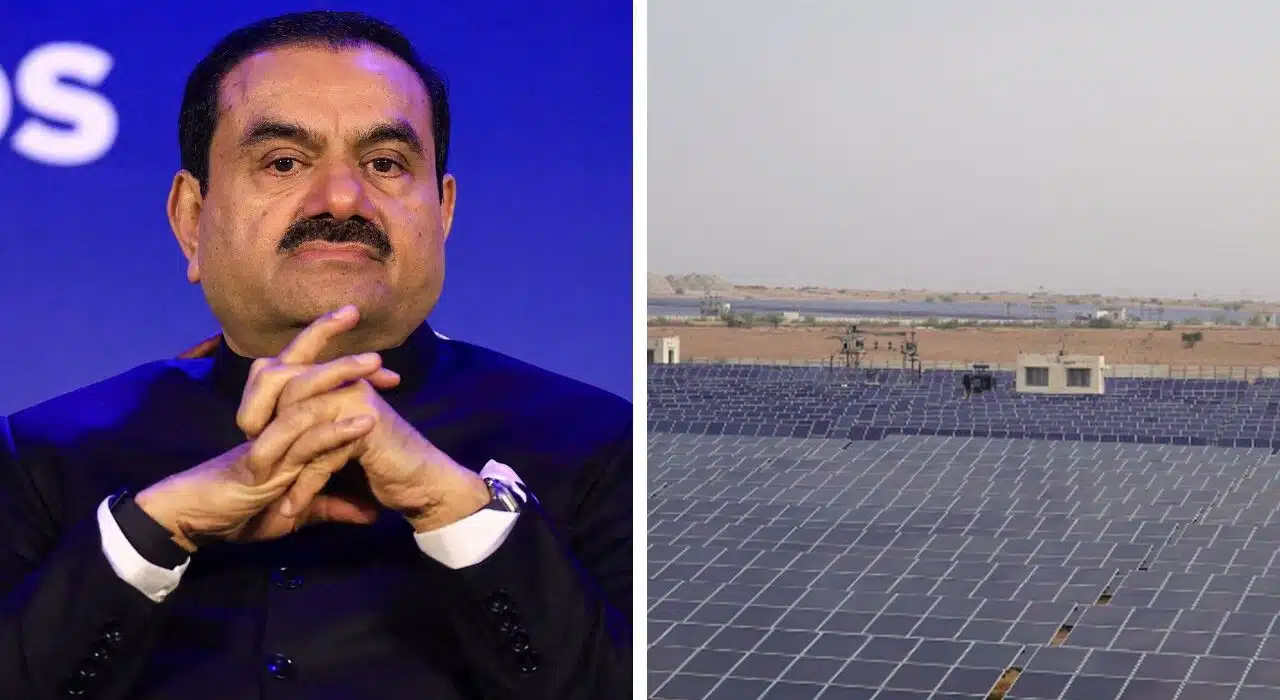

US Government Alleged Adani Group over bribery

Adani addressed current allegations of bribery by the US government to win renewable energy contracts. He focus that no one from the Adani Group charged with violating the United States Foreign Corrupt Practices Act (FCPA) or conspiring to hinder justice.

Adani highlighted the institution’s resilience, and said, “Even in the face of storms and relentless scrutiny, the Adani Group not sponsored down. True management built in the fire of crisis.” He said that final year’s allegations from the US Department of Justice and the SEC concerning Adani Green Energy unfounded, and no fees made against the group.

Investment Plan of $20B focus on growth

Adani provide overview of the organization’s overall financial performance. It note a 7% sales growth, an 8.2% growth in EBITDA, and a overall debt-to-EBITDA ratio of 2.6x. With this, total sales reached Rs 2,71,664 crore and EBITDA stood at Rs 89,806 crore.

Adani Group outlined plans for an annual capital expenditure of USD 15-20 billion over the next 5 years, and targets 50 GW. These investments aim to build infrastructure and create new opportunities for India.

Read also: AAP Party wins Ludhiana Bypoll with 10,637 votes and Defeat Congress