India is an incredibly unique environment for startups and entrepreneurship in general. According to a report published on CNBC 2019, India has been ranked third in the global startup ecosystem. Growing in the startup industry partnering India to be number one and aiming to contribute towards India’s dream of becoming a 5 trillion dollar Indian economy. China playing a leading role in funding and control of many Indian Startups. In 2015, Alibaba invested $680 million in Paytm through its affiliate Ant. Financials. In 2017, Tencent bought major stakes in Flipkart and Ola.

Japan is also a serious funding providers to Indian startups. Japanese giant Softbank has invested over $8B in startups in the country, with a goal of $10B by 2024 that now looks surprisingly conservative.

According to the report tabled by finance minister Nirmala Sitharaman showed the total funding raised by Indian startups in 2018 was $7.5 billion, which was $4.3 billion in 2017 and $3.5 billion in 2016. And, the number of deals has declined over the years to 360 in 2018 from 439 in 2017 and 477 in 2016.

There are a total of 26 unicorn startups in India with a value of over $1 billion and 5 new unicorns has joined this club in 2018 (the most on record for a single year in 2018) – the first name comes into this list of Swiggy which has raised $1.3 billion in funding in Dec 2018, the second name comes of Oyo raised $1 billion in Sep 2018, next is Byju’s $540 million in Dec 2018, Paytm mall $445 million in April 2018, and the last one is Zomato $410 million in Feb 2018.

However, I’m not going to explain all the unicorns, you can learn here on Inc 42 about which Indian companies are unicorns in India?

Instead, I’d love to forward this article for the new startups from the past few years emerging in the Indian market. I believe most of the startups you haven’t heard of them. However, many of these Indian startups will be household names over the next few years and not just in India!

Top 10 Indian Startups to Watch in 2019

1. Ask Arvi: Insurance via Chatbot

Ask Arvi is India’s coolest chatbot application that makes protection brilliant, straightforward and social. Whether it is guarantee proportions or human services costs, Arvi causes you to make educated, information-driven choices.

Arvi comprehends your inquiries and intelligently answers them with a blend of information, data, and pre-recorded expert videos.

Ask Arvi has situated itself as an innovation layer overall significant Indian safety net providers. At the very least, they will be an extraordinary obtaining project for any of those huge organizations.

AskArvi.com is funded by 2 investors. Amadeo Brenninkmeijer and Jang Capital are the most recent investors. It’s one of the top Indian startups to watch in 2019.

Headquarter in: Mumbai

Total Funding: Not disclosed.

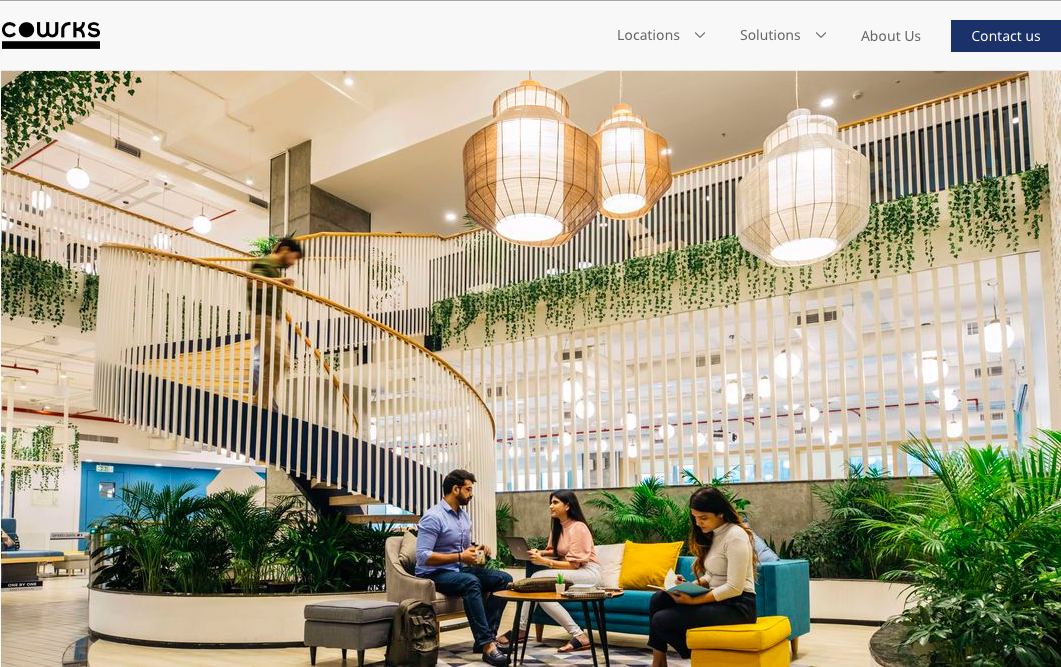

2. CoWrks: We work for India

CoWrks is a premium homegrown co-working solution provider that assembles workspaces for organizations of all sizes. CoWrks is the leader in the quickly growing India cooperating industry that incorporates huge players like Awfis and Innov8.

While there are numerous players in the space, the socioeconomics and geology of India imply that we’ve quite recently begun. CoWrks has 34+ operational focuses in 5 urban areas all over India with a presence in Mumbai, Gurgaon, Bengaluru, Chennai, and Hyderabad. CoWrks also branching out to more metros and Tier 2 urban areas.

The organization claims 10,000+ growing member base from the varied category of businesses. CoWrks ranked at number 2 position in 2019 in newly funded Indian startups.

Locations In: Delhi, Mumbai, Bengaluru, Chennai, Hyderabad

Total Funding: Not Disclosed.

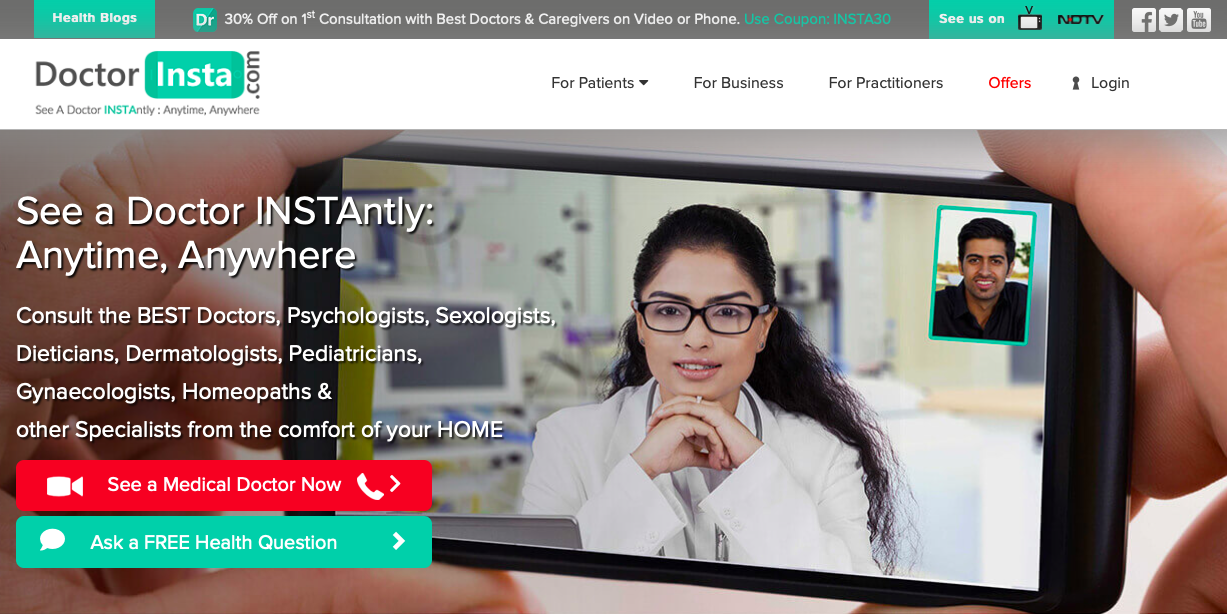

3. Doctor Insta: Teledoc + ZocDoc + CVS for India

Doctor Insta is a leading telemedicine provider in India. They’re an aggregator of numerous orders of medication and give video or telephone “visits” through their versatile application.

All the ‘Doctor Insta Professionals’ are Indian Medical Council authorized Physicians. These professionals provide services through the Doctor Insta telehealth platform.

If necessary, they can allude patients to US doctors for a subsequent feeling or to an in-person visit or test. Furthermore, they can satisfy remedies through their drug store, making them an incredible one-stop-shop and one ready to develop quickly in 2019.

Headquarter In: Gurugram

Total Funding: $7 MM

4. Flock: Slack Competitor, Founded in India

Flock is a team messenger and online collaboration platform which helps organizations to manage and access everyone in your organization with customizable channels and a team directory.

Flock is like Slack yet it is 64% less expensive than Slack and it has built a solid following in India as well as all through the world with over 100k companies utilizing their enterprise chat application. While this fails to measure up to Slack, it makes them a reasonable contender of Slack (and an extraordinary acquisition target).

Offices In: Bengaluru, Mumbai

Total Funding: $45 MM

5. Overcart: Return Management

Overcart is India’s first marketplace for over-stock, unpacked, restored, and used items. With a thorough quality-check process, expert product knowledge, and unparalleled customer focus, this is the most secure spot for you to buy auxiliary items.

Overcart was established in 2012, it is a competitor of US-based return management platform Optoro which has raised over $244MM since it’s established in 2010 and has a valuation close to the unicorn domain and Overcart is trying to bring similar stock advancements (and amazing development) to India.

Overcart ranked at number 5th in the Indian startups list of 2019.

Offices In: Gurugram

Total Funding: $3MM

6. Loan Frame: Small Business Loans for India

Loan Frame is a small business loan provider in India, aiming to build the largest SME lending marketplace in the sub-continent. It is a Fintech company where ambition meets ability.

India is evaluated to have over 42MM SMEs, utilizing around 106 million individuals, 40% of India’s workforce. These organizations contribute over 6% to the assembling GDP and over 24% to the administration division GDP. SMEs overall are becoming over 10% yearly.

With this gigantic scale and quick development, Loan Frame is well-situated to give the credit these organizations need to scale.

Loan Frame won India’s most prestigious financial sector awards—FE Best Banks awards 2019 – in the fintech class.

Headquarter In: New Delhi

Total Funding: $2.3MM

7. Instavans: Logistics Optimization for Shippers

Instavans is an on-demand platform that offers price transparency, ease of access, and a better end-to-end experience for both shippers and truckers.

It is a real-time platform to associate shippers and truckers, with automatic dispatch.

Did you realize that trucks move around 2 billion tons of cargo locally in India consistently? That is near 60% of all cargo tonnage moved in India including rail, sea, and air. That is a surprising measure of stuff – India would be injured without trucks. What’s more, it’s getting much greater. Likewise, with other transportation divisions, neighborhood trucking corresponds well with the large scale market and industry incomes are required to increment as customer spending and mechanical generation increment.

By accumulating an enormous number of local truck operators, Instavans has assembled a “virtual fleet” that is bigger than some other neighborhood supplier.

Offices In: Bangalore

Total Funding: $2MM

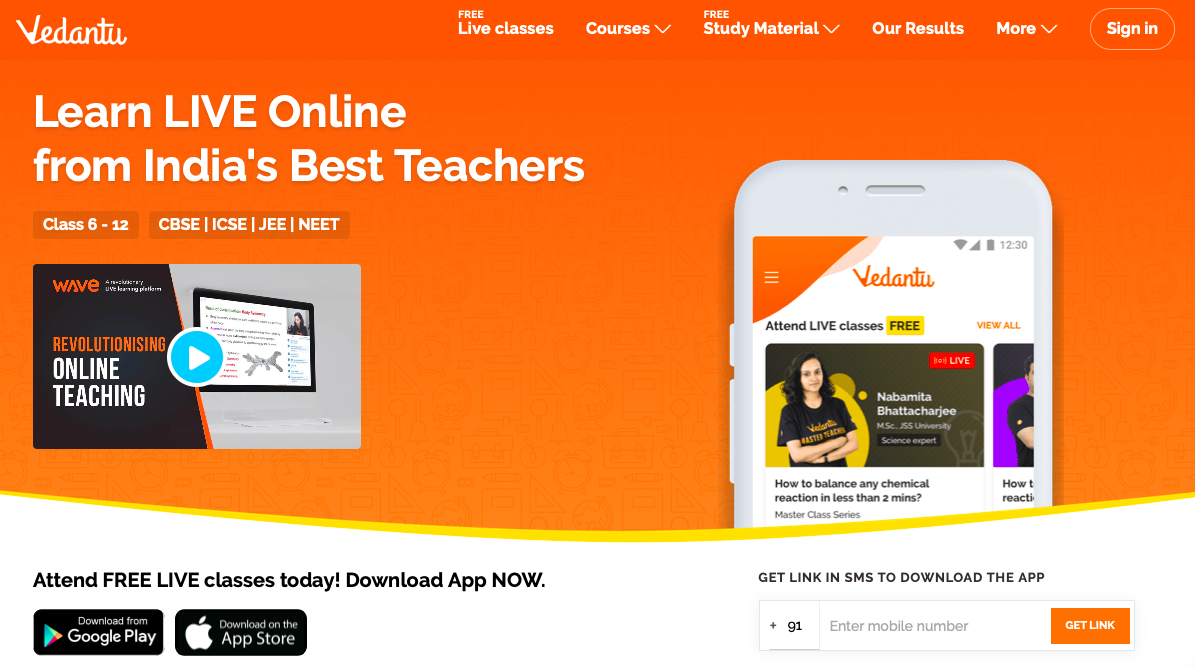

8. Vedantu: VIPKid for India

Vedantu’s innovative LIVE platform is intended to make a healthy peer learning environment and promote student interaction. LIVE In-Class Quizzes in a gamified way make learning fun and the Real-Time Leaderboard pushes kids to exceed themselves and perform better.

Like VIPKid, which is developing at inconceivable rates in China, Vedantuis ready to take advantage of that equivalent need in neighboring India. Vedantu offers a wide scope of online classes and tests planning live from India’s best teachers.

Vedantu is now surrounding 1MM students and is ready to quicken that development in 2019.

Offices In: Bangalore

Total Funding: $16.6MM

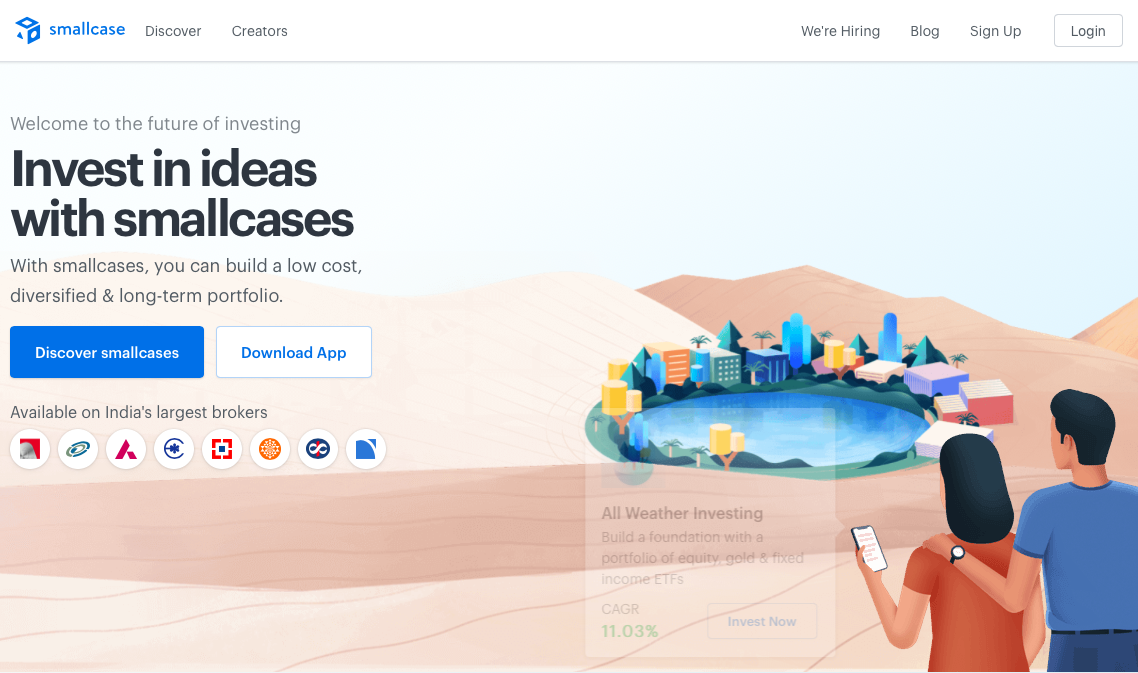

9. smallcase: Thematic small-scale investing

smallcase is bringing a simplified thematic investing approach to the growing Indian middle class. Right now, like a significant number of the FinTech companies that have developed quickly in the US, including Stash, Acorns, and Motif Investing.

smallcases are portfolios of stocks or ETFs, weighted intelligently to track a theme, system or target. It is a bushel of stocks that reflects an idea.

In India today, just 15% of the populace holds wealth in financial assets. In China, 40% puts resources into monetary resources, while in the US, the number is 70%.

This represents a massive opportunity for smallcase and other FinTech new businesses to give simple access to financial instruments as well as the instruction that requirements to go with such a significant change.

smallcases are assembled and oversaw by SEBI authorized experts, utilizing quantitative models and calculations to screen and weight constituents.

Offices In: Bangalore

Total Funding: $8MM

10. DocTalk: Patient Management Software for Doctors

DocTalk is a CRM and patient management platform for Doctors in India which stores medical reports and medicines and effectively share them with your Doctors.

DocTalk not just engages specialists to grow better associations with their patients yet, in addition, gives patients a superior nature of care with more timely automated follow-ups.

DocTalk is funded by 15 investors. Paul Buchheit and AltaIR Capital are the most recent investors. The company has also two lead investors.

DocTalk uses 9 technology products and services including Google Analytics, G Suite (formerly Google Apps for Work), and Bootstrap.

DocTalk ranked at number 10 in the list of top Indian startups of 2019.

Offices In: Hyderabad

Total Funding: $5MM

Crunchbase Rank: 6,336

Also Read: India Signs MoU for Four Infrastructure Projects with Marshall Islands in the Pacific

3 Comments