- SG Finserve Limited is expected to have strong operational synergies with AATL and its subsidiaries and will only provide credit to dealers and vendors of AATL in near term.

- SG Finserve will continue to get strong support from APL Apollo Group.

SG Finserve Ltd – About the company

SG Finserve Limited- SGFL (formerly known as Moongipa Securities Limited) is a non- banking finance company, catering to supply chain financing solutions for Indian conglomerates up to last possible tier. Shares of the company are listed on BSE and it is registered with Reserve Bank of India as Non-Banking Finance Company. The company carries out business of investing activities, investment research, investment banking and wealth management.

Board of Directors of the company in its meeting conducted on August 10, 2022 proposed change in name of the company to “SG Finserv Limited”.

Business model of SG Finserve Limited

SG Finserve Limited offers financing solutions to dealers/distributors, vendors, retailers, logistic providers etc. with support of seamless tech platform solution. The company is accredited with CRISIL AA rating for its long-term debt and an A1+ for its short-term debt & commercial paper. As a result, the company can be considered as a strong and reliable financial institution. Established in 1994, the company was a SEBI registered broker. This operation of the company ceased in year 2008. Thereafter, it started carrying out operation of trading into equity shares of listed companies using its own funds. Later on, in year 2018, it decided to apply for registration as non-banking financial institution with Reserve Bank of India.

Ashish Kacholia buys fresh stake

According to recent shareholding pattern, Ashish Kacholia holds 1.17% stake in the company. Data which was released was for the April to June quarter (1Q24). Stock price of the company has increased by ~369.26% in just one year, delivering multibagger returns to its shareholders.

Track record of management

SG Finserve Limited has strong confidence in significance of corporate administration rehearses which ensure responsibility, straight-forwardness, and adjusting interests of multitude of partners. The company’s chiefs include industry specialists who unite figured initiative and experience to plan sound arrangements.

Mr. Sorabh Dhawan is CEO of SG Finserve Limited who graduated from University of Aberdeen, United Kingdom. He has worked with several leading and renowned banks and financial institutions in various leadership roles. His experience spans around 16 years throughout corporate lending with extensive insight of several functions such as business, credit and technology initiatives. Previously, he has worked with leading banks such as Kotak Mahindra Bank, HDFC Bank, and Aditya Birla Finance.

Sahil Sikka is the company’s COO and CFO. Like the company’s CEO, he has worked with some renowned financial institutions and has total experience of around 13 years. His experience spans across Business and Credit in Corporate and Investment Banking departments. He has worked with HDFC Bank, Kotak Mahindra Bank and Aditya Birla Finance.

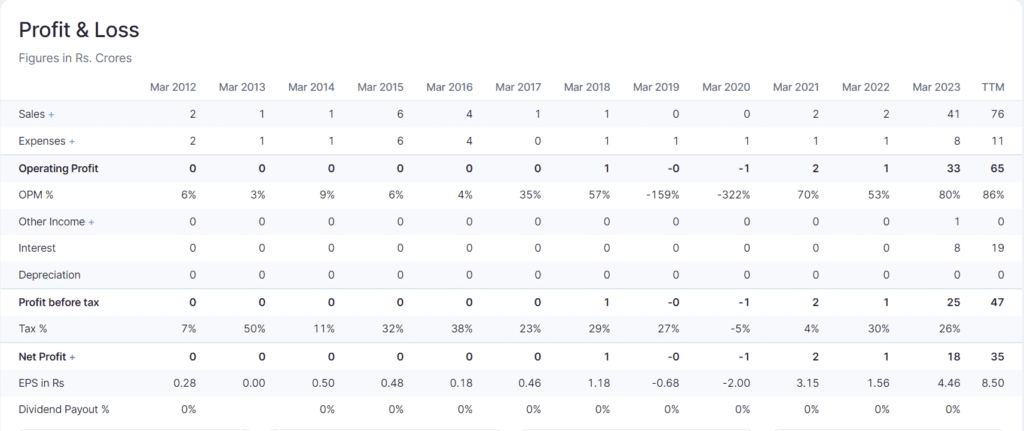

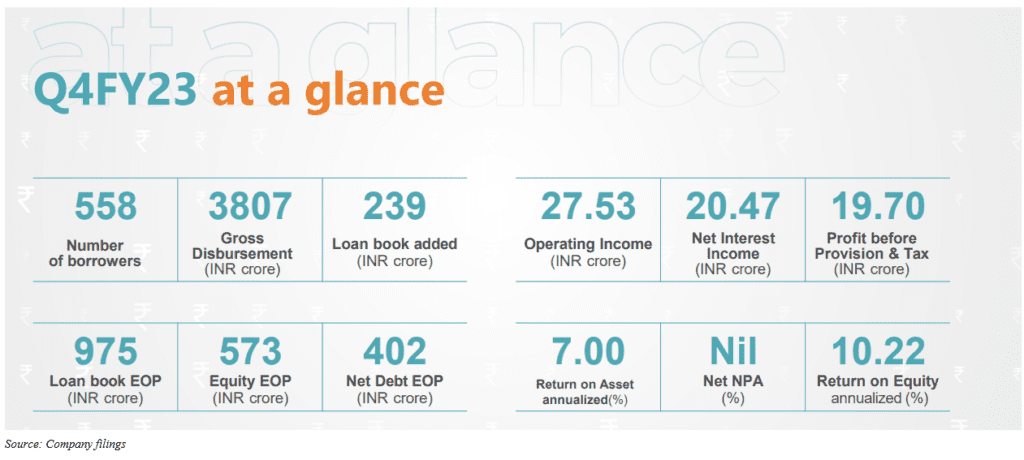

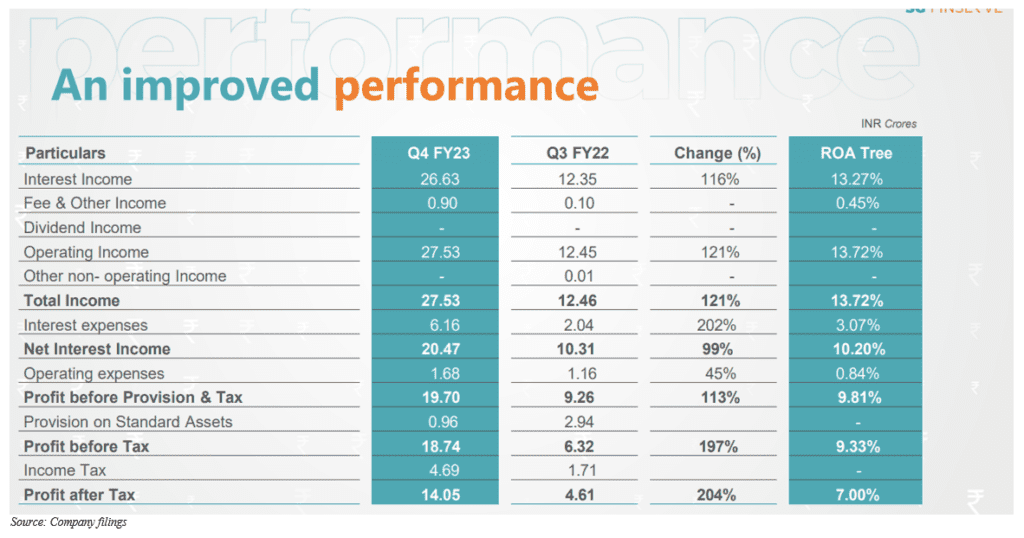

Financial performance of SG Finserve Limited

During FY22, the company saw total revenue and net profit of INR2,19,45,950 and INR78,44,240, respectively against total revenue and net profit of INR2,39,50,083 and INR1,57,91,906, respectively during FY21. The company has released earnings results for Q1 ended June 30, 2023. In 1Q, the company saw revenue of INR348.4 million in comparison to INR0.363 million in previous year. Net income of the company came in at INR156.4 million against net loss of INR8.21 million in prior year. Activities of finance and investment companies in India saw some qualitative changes over past few years. They have become widely prominent in a wide range of activities. By now, role as effective financial intermediaries is well recognized as they have ability to make certain inherent decisions, take on greater risks, incorporate innovative marketing strategies and customize products and services as per needs of clients. Collectively, all these factors have supported the company financial results.

It is a proven fact that, to have healthy financial and investment sectors in a country like India, there need to be a sustainable marriage between primary lending institutions (such as Banks and Fls) and intermediaries. This is important so that both these parties adhere to their core competencies and not compete with each other unnecessarily.

The company’s FY23 financial results were supported by several factors. It has targeted top tier anchors in pre- selected industries and it saw benefits of strategic geographical expansion. The company is live in 14 locations now. SG Finserve Limited continued to focus on seamless digital customer journey- including on-boarding, credit assessment, facility documentation, disbursement and monitoring.

All such changes have worked in favour of SG Finserve Limited as the company has delivered good profit growth over past 5 years. It has healthy return on equity track record (3 Years ROE came in at 84.5%).

CRISIL ratings revised its outlook to ‘Positive’ from ‘Stable’ and gave its ‘Provisional CRISIL AA(CE)/Positive’ rating to enhanced bank loans facilities of INR500 crore of the company. Agency reaffirmed ratings of ‘CRISIL AA(CE)/Positive/CRISIL A1+’ on bank facilities of INR500 crore and debt instruments of SG Finserve.

SG Finserve continues to have strong liquidity base as it has a free cash balance of INR79.82 crore as on September 29, 2022 without any debt repayment obligation. The company plans to raise short-tenured debt in future and might lend for short tenor of 30 to 90 days. CRISIL Ratings anticipates that client will keep liquidity equivalent to 2 months of debt repayment requirements on a regular basis.

Future prospects of SG Finserve Limited

Non-banking financial companies (NBFCs) are considered as most important pillars for ushering financial inclusion in India, reaching out to under/unserved populace and in process resulting in “formalization” of credit demand. Such companies cater to needs of both retail and commercial sectors.

In past, there have been times where such companies have been able to develop strong niches with specialized credit delivery models which even larger players such as banks have found hard to match. This has further offered a fillip to employment generation and wealth creation. In doing so, there has been economic progress to weaker sections of Indian society. Such measures provide significant opportunities to the company and it should be able to capitalise on such opportunities.

Receding pandemic impact, rising private investments, higher consumption levels and thrust on capital expenditure in Union Budget should help in higher growth for the company. As a result, a better performance is expected for the company in upcoming years.

Given its strong parentage, brand recognition, liquidity and distribution network, the company should be able to achieve above-average growth and might see an increase in market share throughout all segments with introduction of new products.

Industry analysis

Over past several years, Non-Banking Financial Companies (NBFCs) played prominent role in Indian financial system as they gave financial inclusion to underserved section of society not having easy credit access. NBFCs revolutionized Indian lending system and these institutions have efficiently used digitization to support efficiency and offer customers with quick and convenient financing experience.

Range of services are being offered by them such as vehicle financing, MSME financing, home financing, microfinance and other retail segments. Indian government continues to work on governance measures to support systemic importance of NBFCs. As of January 31, 2022 there were ~9,495 NBFCs registered with Reserve Bank of India (RBI), of which 49 were deposit-accepting NBFCs.

In July 2021, Rajya Sabha gave its approval to Factoring Regulation (Amendment) Bill in 2020. This has allowed 9,000 NBFCs to take part in factoring market. Bill also provides central bank authority to set up guidelines for improved oversight of US$ 6 billion factoring sector.

Future capital spending of Indian government should be supported by several factors including tax buoyancy, sound and reliable tax system, thorough assessment and rationalisation of tariff structure and tax filing digitisation. In medium term, higher capital spending on infrastructure and asset-building projects should increase growth multipliers. Revival in monsoon and Kharif sowing supported agriculture sector gain momentum. As of July 11, 2022, South-West monsoon covered entire country, leading to 7% higher rainfall than normal level. India has been categorised as fastest-growing major economy and should be one of top 3 economic powers globally in time span of upcoming 10-15 years. This is expected to be supported by strong democracy and partnerships.

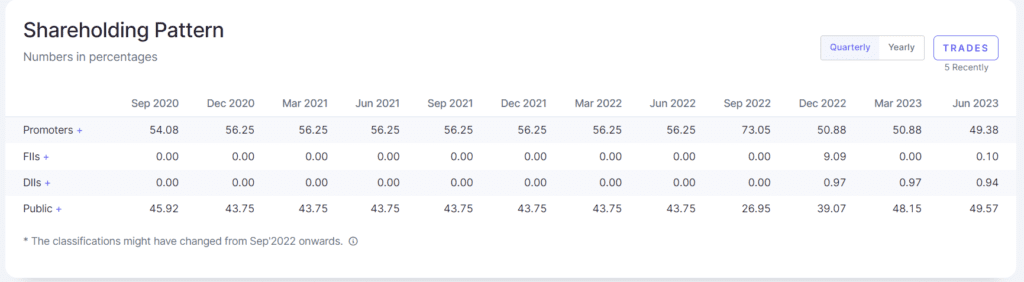

Shareholding pattern of SG Finserve Limited

Promoters of SG Finserve Limited held ~49.38% stake in the company by end of June 2023 while ~49.57% was held by public shareholders. Mr. Rohan Gupta was holding ~24.69% stake in the company by end of June 2023. Mr. Rahul Gupta also held ~24.69% in SG Finserve Limited.

The companies having higher promoter holding are often considered as a stable one in comparison to those with low one. This is because promoters are considered as long-term investors committed to the company’s growth and success.

Risk factors

Past couple of years were challenging for SG Finserve Limited on account of pandemic during which both business and collections were impacted significantly. The company’s business operations might suffer during elevated levels of retail inflation, crude oil prices and supply chain disruptions. Any fluctuations in interest rates might impact the company’s margins.

Any sort of loan re-pricing can result in lower demand and deterioration in credit quality for small borrowers.

Valuation and investment rationale

Stock of the company currently trades at ~47.04x of FY23 sales per share in comparison to sectoral average of ~56.43x. Therefore, the company’s share trades at a deep discount, hinting that investors should consider going long on this stock. Significant upside is expected in stock price given continuing, unconditional and irrevocable corporate guarantee by AIPL, strategic importance to APL Apollo group and healthy capitalisation metrics for present scale of operations.

APL Infrastructure’s total stake in APL Apollo came in at 28.13%, which translates to a market value of INR10,300 crore as on June 28, 2023. Market value of such stake seems to be healthy in comparison to its total debt cap of ~INR1,160 crore (INR160 crore as on March 31, 2023, and corporate guarantee of INR1,000 crore offered to its group company- SG Finserve Limited- Rated CRISIL AA(CE)/ Positive/ CRISIL A1+) resulting in a cover of 9 times.

SG Finserve is expected to be principally engaged in activities of channel financing for dealers of AATL and further expand to offering same to retailers.

5 Comments