The Indian freelance market is the second fastest-growing in the world. Since India has many favorable tax rules for freelancers and offers many savings opportunities, freelancing is more lucrative now. In accordance with the IT Act, freelancers have to file income tax returns and pay taxes, just like anyone else who earns income. Unlike salaried individuals, freelancers in India must file their income tax returns differently. Find out how tax applies to freelancers, how to file taxes, and how to save taxes in this article.

What is ‘Freelancing’ As Per Income Tax Rules?

India’s Income Tax Laws define ”profits and gains from the practice of business and profession” as any income derived from an individual’s hands-on or intellectual skills. In terms of taxation, freelancing falls under the category of business and profession. There are many consultants and professions that qualify as freelancers, including blog consultants, software developers, content writers, web designers, tutors, and fashion designers. Tax filing for freelancers can be a bit complicated due to incomes originating from various sources.

Applicability of Tax Filing for Freelancers

Income Tax and GST (Goods and Services Tax) apply to freelancers in India. When a freelancer’s aggregate turnover reaches over 20 lakh rupees (Rs. 10 lakhs for states in the North East and the hills), he has to register as a GST-registered contractor. GST is charged at 18% on most services. In the case of freelancers, the GST rate may vary according to what they are offering.

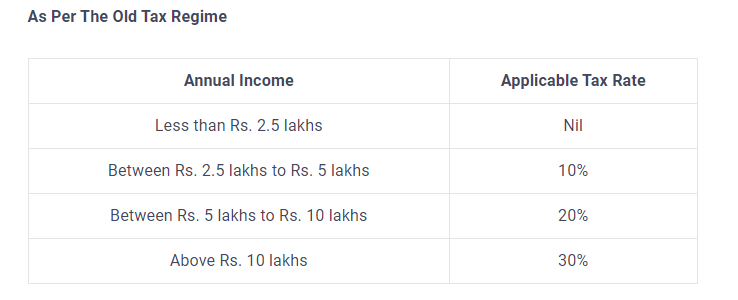

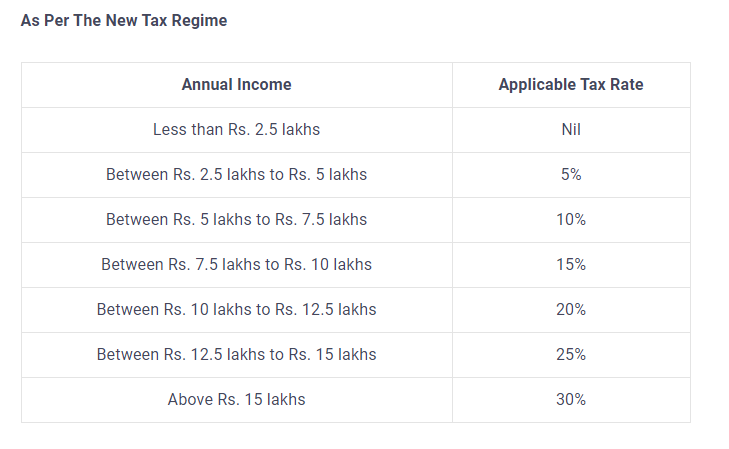

In addition, freelancers must pay income tax at the applicable rate. Below are the income tax rates applicable to freelancers who are younger than 60 years of age:

Freelancers can claim tax deductions depending on which tax regime they choose. According to section 44ADA of the Income Tax Act, 1961, individuals and organizations can make use of the Presumptive Taxation Scheme and only pay income tax on half of their gross annual income, provided the total income is less than Rs 50 lakhs.

The business income must be subject to a tax audit if the gross revenue is in excess of Rs. 1 crore.

Whenever a freelancer pays a professional more than Rs. 30,000 (in total during the financial year), TDS is applicable at a rate of 10%. ITR-4 forms are available for freelancers under the Presumptive Taxation Scheme, which allows them to file income tax returns. The ITR-3 form should be used for freelancers who do not benefit from the Presumptive Taxation Scheme. This is for professions and businesses. For the FY 2020-21 and AY 2021-22, the ITR filing deadline is 30th September 2021.

Tax Filing for Freelancers: The Process

Following are the simple steps to follow for Tax Filing for Freelancers:

- Go to the Income-tax e-filing portal

- Click the ‘download’ tab to access ITR-4

- Fill out the form ITR-4 completely. The filing of general information includes total gross income, deductions, taxable total income, information about business and profession income, details about TDS (those deducted at source), and information about advance tax and self-assessment.

- Using Form 26AS, calculate your taxes. You may be able to claim tax exemptions and deductions..As a freelancer, you can claim any expenses exclusively incurred for the freelancing work conducted during the tax year, such as rents, repairs, travel, local taxes on business property, domain registration costs, etc.

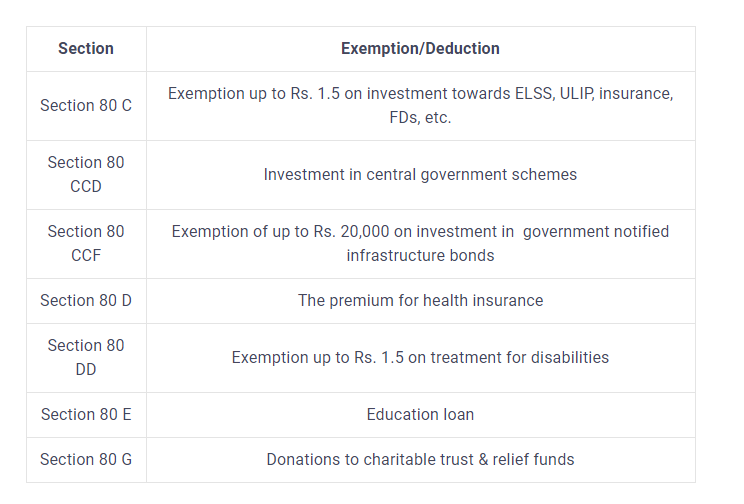

Here are some of the applicable exemptions/deductions:

There are two ways to file your tax return:

- To fill out the ITR-4 form offline, download it, fill it out offline, save the generated XML file, then upload it.

- After e-verification, you can submit the ITR-4 form by completing the form online at the income tax e-filing portal.

The freelancer must pay advance tax every quarter if his/her tax liability in the tax year exceeds Rs. 10,000.

Paying advance tax is easy with this simple procedure

- To access the tax information online, go to the IT department

- Proceed with option 280 of challan 280

- Provide your contact details and the mode of payment you are choosing by choosing (0021) income tax other than companies, selecting your tax payment type, selecting the correct assessment year, and entering your information.

- Make sure all information is correct before moving forward

- Get a tax receipt after you pay

- Maintain the receipt for providing the same information when filing your income tax return.

Freelancers can reduce their tax burden and file tax returns more easily if they understand the tax rules and the benefits of presumptive tax schemes.

Also Read: How to Invest in IPO-IPO Investment Tips

4 Comments