Artificial intelligence is still a mysterious concept for the average consumer, who wonders how it will penetrate their daily lives. In the financial world, however, it is undisputable that businesses are cashing in on its potential.

2024 has been a phenomenal year for the stock market, especially for the tech sector. The Nasdaq is up an impressive 33%, and other U.S. stock indexes have also experienced significant double-digit gains. Companies that have benefited from the rapid acceleration of AI technologies have emerged as major players in this rally. Chipmaker Nvidia is one of them, but it’s far from the only one.

Cryptocurrency also played a pivotal role this past year. With the introduction of spot bitcoin exchange-traded funds early in January, the crypto market has experienced a whirlwind year. This surge gained momentum following Donald Trump’s election victory, which received considerable backing from the crypto sector, benefiting several related stocks.

As the calendar year draws to a close, let us take a closer look at the five top-performing U.S. tech and AI stocks 2024-particularly those with market capital over $5 billion.

Top 5 U.S. tech and AI stocks

AppLovin: From Gaming Studio to Ad Powerhouse

Starting the year with a market capitalization of around $13 billion, AppLovin was pretty much known for its investment in several mobile gaming studios. The company has found popularity with titles like “Woody Block Puzzle” and “Bingo Story.” Now, as the final months of 2024 approach, AppLovin’s valuation has gone shooting over $110 billion in valuation, surpassing giants such as Starbucks and Airbnb. The firm’s share prices have skyrocketed at a phenomenal 758% within the year.

While AppLovin went public in 2021 with the boom in gaming, it is shifting toward digital advertising and AI-driven profitability. AXON 2.0 is its new revamped ad search engine, which transformed targeted advertising for its applications of gaming. This move increased software platform revenue by a staggering 66%. According to CEO Adam Foroughi, the company has high hopes for an upcoming e-commerce venture and expects to see promising results soon.

MicroStrategy: A Bitcoin Custodian

MicroStrategy’s performance has equally shocked onlookers. While it gained a whopping 346% last year, the company surged another 467% in 2024 following its aggressive bitcoin investment policy spearheaded by its founder Michael Saylor. Since it declared its bitcoin acquisition policy in 2020, MicroStrategy has acquired more than 444,000 bitcoins, making it the world’s fourth-largest holder of bitcoins. Its market cap has increased from about $1.1 billion to an astonishing $80 billion.

Michael Saylor attributes this amazing growth partly to Trump’s recent election victory, which implies that renewed support for Bitcoin will drive broader growth in digital assets.

Palantir: Data Analytics in High Demand

Palantir Technologies has also been the talk of the town as its stock price rose 380% this year. The company highlighted its potential for revenue during an earnings announcement right before the presidential election, promising high growth through AI-driven demand. In an interview, CEO Alex Karp said that the financial performance of Palantir is above expectations since it capitalizes on increasing needs from government and commercial sectors.

Robinhood: Crypto and Stock Trading Boom

Despite a dip in shares earlier this fall, Robinhood’s stock price has tripled in 2024. Analysts attribute this growth to the rising interest in cryptocurrency trading through the app. Revenue from crypto transactions soared by 165% in the third quarter, highlighting the platform’s significance in the retail investment landscape.

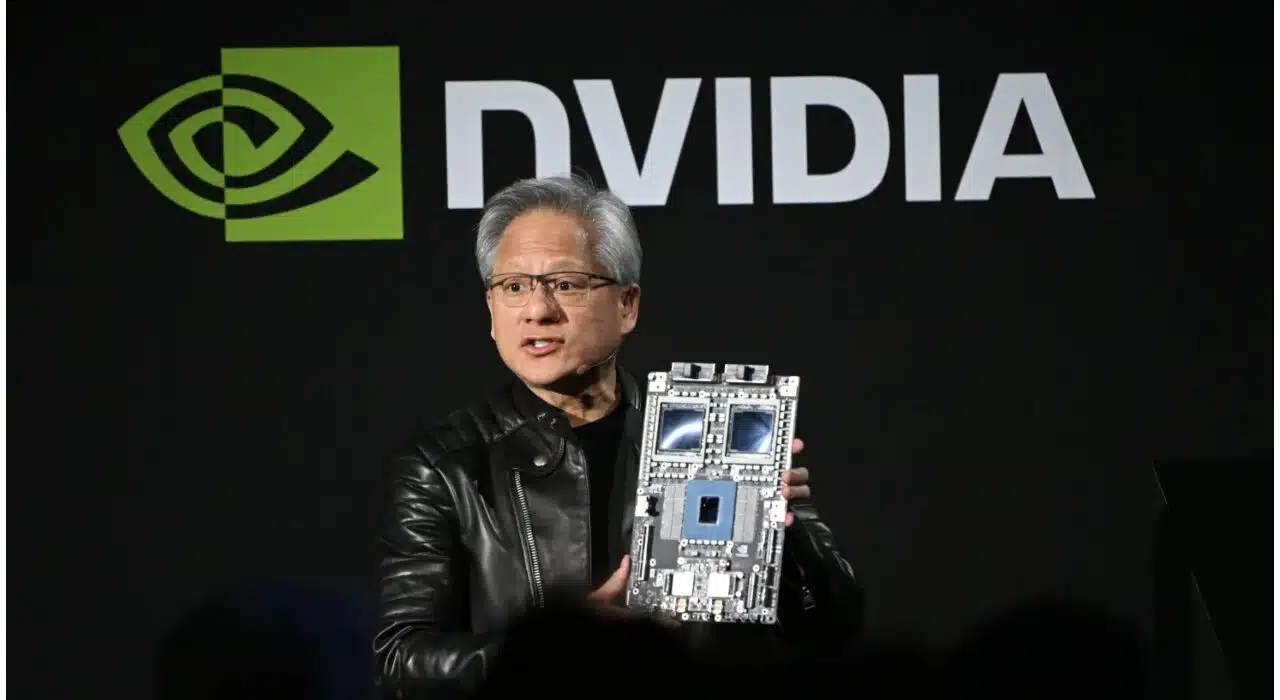

Nvidia: The AI Champion

Last but not least, is Nvidia, which, after a wonderful 239% increase during 2023, did it again with an 183% increase this year. The company’s market capitalization has ballooned sometimes to the point of rivalry for the title of the most valuable publicly traded company. For Nvidia, innovations in artificial intelligence technology and its being a crucial player in the world of cloud computing speak for themselves as businesses throw themselves headlong into applying AI solutions.

With this in mind, these tech stocks mark how well artificial intelligence, cryptocurrencies, and the healthy economy are interrelated. From emerging opportunities each has seen, they were able to capture significant interest from the investors, leaving it interesting for 2025.

Also, see: Manmohan Singh passes away aged 92: Here is how he contributed to Indian economy