India’s banking system is in a much better position today to handle global shocks. This improvement comes from cleaner balance sheets, stronger capital reserves, and careful financial management. Chairman of the SBI, CS Setty mentioned that years of reforms and stricter regulations have strengthened banks. This has improved their ability to support economic growth, even in uncertain global conditions.

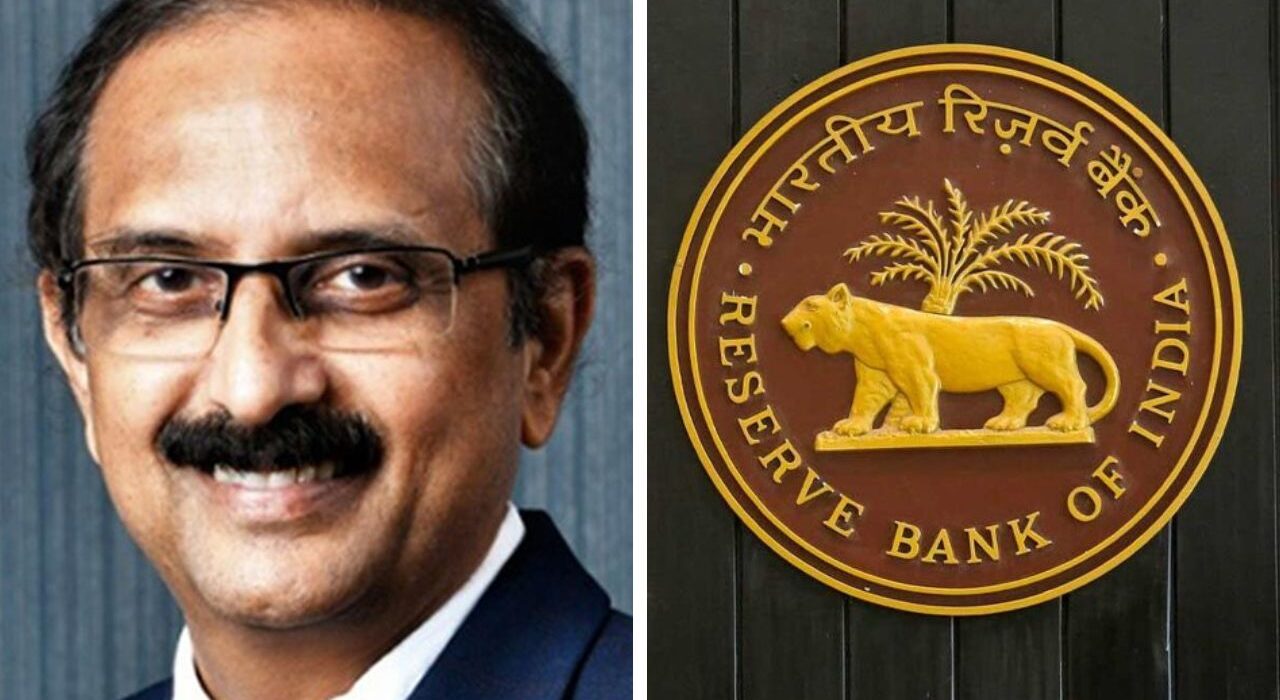

SBI chairman talk about India Banking System

In an interview with Siddharth Zarabi, Setty discussed ongoing geopolitical tensions, trade disruptions, and tariff-related issues. These factors continue to pressure economies, including India. However, he noted that the country has managed these challenges well. The use of careful financial practices, sufficient liquidity, and ongoing government spending on infrastructure has helped.

Setty emphasized that India’s growth outlook is strong. He cited the latest IMF estimates and the bank’s own assessment, noting that India’s GDP growth is around 7.5%. He described this as a resilient story and expressed optimism for both calendar year 2026 and the fiscal year 2027.

Strengths of India Banking System

A key difference between India and many other economies is the strength of its banking system, Setty said. He remembered that after the global financial crisis and its effects, India conducted one of the largest clean-ups of bank balance sheets through asset quality reviews and recapitalization. He said that this process has significantly strengthened the system.

While Setty acknowledged that India cannot completely separate itself from global events, he pointed out that the country is now much more resilient in facing external disruptions. Improvements in regulations, better risk management by banks, and stronger capital reserves have all contributed to increased financial stability.

From a banking standpoint, he mentioned that SBI plays a significant role in supporting trade activities. Of the bank’s overseas portfolio of about $90 billion, nearly $25-27 billion is dedicated to trade finance, which mainly funds Indian companies entering global markets.