Talbros Automotive Components Limited was established in year 1956 and is being counted as one of India’s leading manufacturer of automotive components. The company has well-established presence. For 6+ decades, the company was able to add value for its clients as its focus was on unmatched quality and superior technology. Products of the company include gaskets, heat shields, forgings, chassis systems, suspension systems, anti-vibration components and hoses. The company has a diversified product basket and it caters to several automobile segments such as passenger vehicles, commercial vehicles, two- wheelers, three-wheelers, Agri, off-loaders and industrial etc. Strategic alliances with renowned global companies supported the company to deliver best-in-class auto components to customers.

Growth enablers of Talbros Automotive Components Limited:

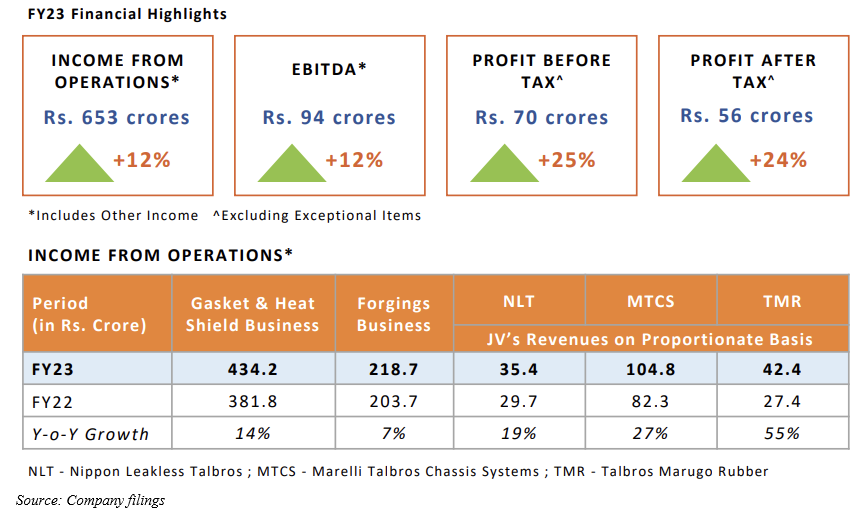

- Healthy results lay the strong base: In FY23, Talbros Automotive Components Limited saw its revenues coming at INR1,037 crore, exhibiting a growth of 18% year-over-year. Over the last year, it has successfully received new multi-year orders of over INR1,000 crores. These orders were received from both, domestic and overseas customers. In FY23, exports made the contribution of 16% of Gaskets Revenue, 52% of Forgings Revenue, 17% Marelli Talbros Chassis Systems, 8% of Talbros Marugo Rubber, and 0.02% of Nippon Leakless Talbros. The company’s total income from operations saw an increase of 12% year-over-year to INR653 crores, with EBITDA of the company coming at INR94 crores. The company’s continuous innovation in the new products such as heat shields, strengthening of EV portfolio, increasing orders from the non-automotive segments, and strong clientele have jointly contributed to its results.

- Strong global partnerships should stem growth: Talbros Automotive Components Limited has strong global partnerships and these partnerships should continue to supplement growth.

- Nippon Leakless Talbros Pvt Ltd: Nippon Leakless Corporation is being counted amongst largest global manufacturers of gaskets and is a big supplier for Honda. Talbros has a share of 40% and sales are 100% being made to OEMs to Honda and Hero.

- Marelli Talbros Chassis Systems Pvt Ltd: Magneti Marelli S.p.a is a fiat group company having annual revenue of €6+ billion and is a 50:50 partnership company which started production in Apr 2012. Its 100% sales are being made to OEMs and important customers include Maruti Suzuki India, Jaguar Land Rover, Suzuki Motors Ltd, Magna Steyr Fahrzeugtechn and Bajaj Auto.

- Talbros Marugo Rubber Pvt Ltd: Marugo Rubber Industries Ltd is a global leader in supply of anti-vibration product and hoses. Top customers include Maruti Suzuki, QH Talbros, Daimler India Commercial Vehicle Pvt Ltd, Tamil Nadu and Suzuki Motors Gujarat Pvt Ltd.

- Focus on export market and product development: The company was focused on making operations stronger and enlarging its footprint globally through innovative solutions and strong manufacturing capabilities. The company is expected to seek support from global synergies and wide geographical footprint. The company should be able to capitalize on opportunities coming because of new regulations and focus is on providing future-oriented products to esteemed customers. The company caters exports to USA, UK, Europe and Japan. New orders provide a huge validation of the company’s technical capabilities and open doors for several new customers. In these uncertain times, orders are expected to hugely benefit brand equity of Talbros Group. The company expects that these orders clearly provide long-term visibility and positive environment. The company continues to maintain focus on exports and on technical validation of its products. In its gasket business, the company is totally BS-VI ready. The company focuses a lot on technology to help localize a lot of raw material imports. The company has made raw material sourcing agreements and these have resulted in savings in operational costs, reduction of raw material inventory and working capital investments.

- Capitalising on industry dynamics: Indian automobile industry is being counted as one of driving forces of this economy, making up ~49% of India’s manufacturing GDP. Since this sector is deeply integrated with several other industrial sectors, it provides a boost to employment, exports and FDI inflows. India is a house of cost-effective operations, efficient manpower and is being considered as a fast-growing dynamic market. Country has emerged as core destination for several multinational automobile companies. Indian automobile industry faced challenges in FY20 and saw a brunt of lockdown. Operations of automobile companies were impacted, resulting in unutilized capacities and production cuts. Automotive industry has a solid and healthy base which should result in quick recovery. Revival is likely to stem from entirely new platforms available as a result of implementation of BS-VI norms. Apart from this, assured income to farmers and rapid urbanization should push vehicle demand. Demand for low emission and fuel-efficient vehicles should enable building of strong ecosystem for electric vehicles.

Company to announce stock split

On Friday, stock price of Talbros Automotive Components Ltd went up by ~8.8% to a new 52-week high of INR863 per share. The company informed that the meeting of the Board will be conducted on August 08, 2023. The Board will consider and approve unaudited financial results (standalone and consolidated) for the quarter ended June 30, 2023. Focus of the company will also be on alteration of the equity share capital through split of its existing equity shares which have a face value of INR10 each. This will be done in the manner approved by Board of Directors.

Much of the stock price increase seen on 21 July 2023 was because of the news about stock split and the company’s optimistic outlook.

Veteran investor Dolly Khanna increased her stake in the shares of the company by 0.47% during 1Q24. After this increase, Dolly Khanna now holds 1.50% stake or 185,715 equity shares as of April-June 2023 period. Shares of Talbros Automotive Components Ltd are also owned other renowned investors like Vijay Kedia and Sanjeev Parekh. Vijay Kedia holds 150,000 shares, exhibiting 1.22% of total paid up capital and Sanjeev Parekh holds 142,681 shares, exhibiting 1.16%.

Conclusion

Growth of automobile industry should provide a base for growth in auto component industry. Good monsoons across India should propel rural demand which should supplement industry growth. Strict emission and safety standards and focus on digital tools in vehicles should make electric vehicles, connected cars and autonomous vehicles a key focus.

Auto industry in India should seek support from aspirations of growing middle-class segment. Electrification saw positive business environment in India. Factors including falling prices of batteries and government’s supportive policies should be able to stimulate segment’s growth. Reduction in emission and less dependency on oil imports are some clear advantages of electrification.

Transportation sector saw several government initiatives in its favour, which should help automobile industry as there can be increase in demand for commercial vehicles. Recent government initiatives should provide needed support to automotive industry. Increase in basic custom duty by government on EVs for complete built ups, semi knock down and completely knock down vehicles in commercial and passenger segment should help promote domestic manufacturing and check electric vehicles imports. Government formulated partial credit guarantee scheme for NBFCs and this can result in improving liquidity and uptake of loans for commercial vehicle. It has abolished custom duty on lithium-ion battery cells import to promote manufacturing of battery packs locally.

The company is expected to see highest contribution from its gaskets business to its revenues from operations.

The company focuses on capturing newer markets and is dedicated on OE contracts with exports. The company should be able to move ahead in this business and support is likely to come from strong order book and relationship with customers.

Read Also:

4 Comments