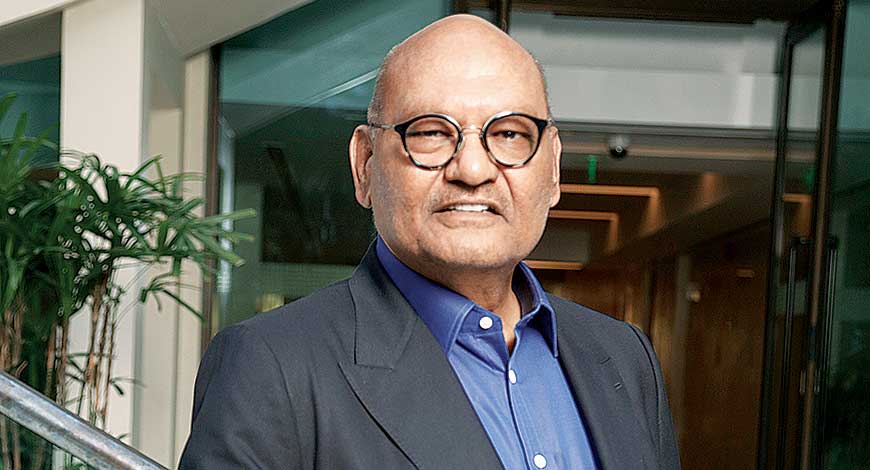

Anil Agarwal announced that he would be investing Rs 1.54lakh crore to set up a semiconductor chipset manufacturing plant in Gujarat. He will be partnering with Taiwan’s Foxconn.

With the new investment, Vedanta has invested a total of ₹25000 crore in Odisha. This investment is key to Vedanta’s future as they hope to empower and infrastructure growth to support their core industries.

Anil Agarwal has made a fortune, but he did not always have the money he has currently. He is the person belonging from Bihar and just knew only two English words – YES or NO, When he came to Mumbai in the 1970s.

Over the last five decades, Anil Agrawal has built a metal and mining company and gotten his first Indian company listed on the London Stock Exchange – Vedanta.

You may wonder how a boy from Bihar who knew only two english words was able to create an international company. Let me hint at this journey with these few sentences.

How starting small led to a London Stock Exchange listing

You would be hard-pressed to find a marwadi boy who does not take up his family business.

The business itself never made him any money, but it would eventually bring him wealth.

After a childhood in Patna, the cultural hub of India, Agarwal left home and moved to the city of Bombay to make his fortune. After two decades of success in Bombay, the interim name for Mumbai were renamed in honour of his contributions to the country.

Agarwal never went to college or a business school. He acquired Shamsher Sterling Corporation, a business on the brink of bankruptcy within a small amount of time.

Mr. Aggarwal borrowed money from his friends and family, supplemented by the loans he took when saving money, to invest in his business. He invested a handsome amount 16 lakh in his business at that time.

Running his scrap trading business simultaneously with his new business eventually became too much.

As the largest producer of copper in India, Sterlite Industries began in earnest with small beginnings. The company launched an IPO in 1988 to finance its plant that manufactured polythene-insulated jelly filled copper telephone cables.

Agarwal bought a sick company for ₹55 crore and used it to set the tone for his business strategy- identifying undervalued assets and turning them around into huge revenue streams.

They took a mine in Tasmania, invested $2.5 million, and made it produce $100 million annually.

The Hindustan Zinc Company had a reserve for five years, and a total zinc production of 1.5 lakh tonnes per annum when he acquired it in 2002.

The company is operational and has expanded its capacity to 1 million tons. They have reserves for another 40 years.

Anil Agarwal Journey From Mumbai to London

As Agarwal moved to Mumbai, his first home was a simple tiffin box and bedding. He eventually rented a room for ₹25 with seven other people.

Staying true to his roots, Agarwal began renting out a small office space in order to buy and sell scrap metal. Following decades of hard work, he built up the business- sharp business skills, knowing how to acquire distressed assets for pennies on the dollar, and taking the company into global markets.

Harshad Mehta tampered with the stock prices of three stocks, and newly listed Vedanta was one. Vedanta’s involvement with Harshad Mehta led to a return in his fortunes.

Learn about Anil Agarwal life story

‘My wife, Kiran, thought I was crazy when I told her that we are moving to London overnight.’ Agarwal shared in a note. ‘She went to our daughter Priya’s school and asked them for a 6-month leave because she was sure we would be back by then.’

Anil Agarwal arrived in England to create Vedanta Resources, a company listed on the London Stock Exchange in 2003. He became the first ever Indian stock broker to have a company listed on LSE.

Over the next decade, Vedanta acquired several mines across Africa, Australia and other regions.

After the mining and metals, Aggarwal turned his eye to the oil industry and bought the largest private sector oil producer in the country at $9 billion.

How an Indian entrepreneur achieved what many of the world’s largest companies couldn’t.

Vedanta Resources Plc merged their four Indian firms into a single corporation in 2012. The name of this corporation is called Sesa Sterlite.

Sesa Sterlite, valued at over $20 billion when merged together, is the seventh largest diversified natural resource company in the world. Prior to this merger, energy expert Jai Agrawal said that this would create an annual savings of over $1,000 crore every year.

Vedanta’s London listing

This is one of Agarwal’s goals. He wants his company Vedanta to be listed on the LSE. 15 years later in 2018, he took Vedanta private and delisted it from the LSE.

Vedanta was undervalued during the commodity slump in 2018, so Agarwal sensed an opportunity to take the company private at a lower price and reap the rewards during the next cyclical upswing.

What’s next?

Anil Agarwal has shifted his focus with this 1.54 trillion rupees investment announcement in Gujarat to reduce dependence on China for semiconductor chips, which is hurting the electronics and automobile industries.

See Also: Meet the woman who has achieved a billionaire status after hearing one discouraging word