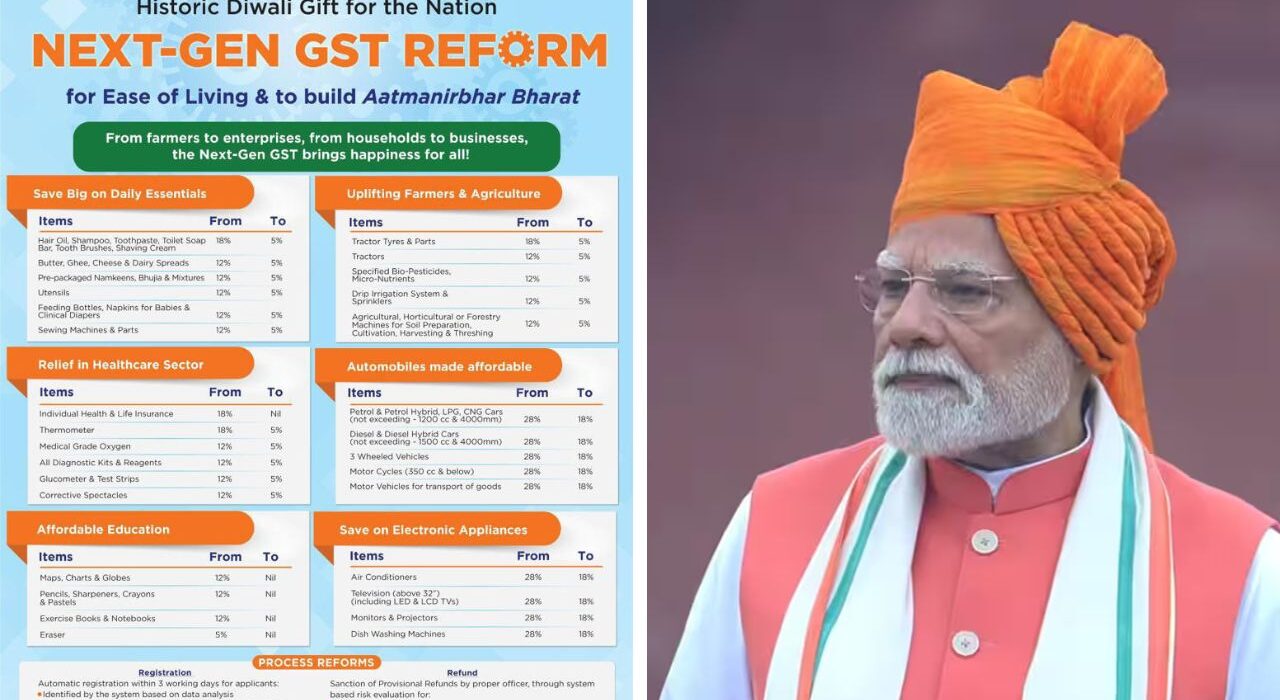

Finance Minister Nirmala Sitharaman announced a major reform in the Goods and Services Tax (GST) system on Wednesday. The 12% and 28% tax slabs will be consolidated into a simpler dual-rate structure of 5% and 18%. A higher 40% rate will remain for sin goods.

This move, called “Next-Generation GST,” that aims to improve affordability, consumption, and economic efficiency while making compliance easier for businesses.

Next Gen GST reforms make essentials cheaper

At a press conference, the Finance Minister stated that these changes focus on reducing the burden on everyday people. She said, “Every tax on the average man’s daily use items has undergone a rigorous review, and in most cases, the rates have come down drastically. Labour-intensive industries, farmers, the agriculture sector, and the health sector will all benefit.”

Daily essentials like hair oil, soap, shampoo, toothbrushes, toothpaste, bicycles, and kitchenware will now have a 5% GST. Ultra-high temperature milk, paneer, chena, and all varieties of Indian breads, including roti and paratha, will be exempt from GST.

Rate cuts across multiple sectors

Food items such as namkeen, bhujia, sauces, pasta, noodles, chocolates, coffee, cornflakes, butter, and ghee will also see GST reduced to 5%. For consumer durables, the tax on air conditioners, dishwashers, and small cars has dropped from 28% to 18%. Motorcycles with up to 350 cc engine capacity will also face an 18% rate.

The Minister added that inverted duty structures and classification issues have been addressed, ensuring stability and predictability in the GST framework. She also pointed out measures to simplify registration, return filing, and refunds.

These next gen reforms support Prime Minister Narendra Modi’s Independence Day announcement that GST changes by Diwali would lower taxes on everyday essentials, benefit MSMEs and local vendors, and promote a citizen-friendly economy.

1 Comment