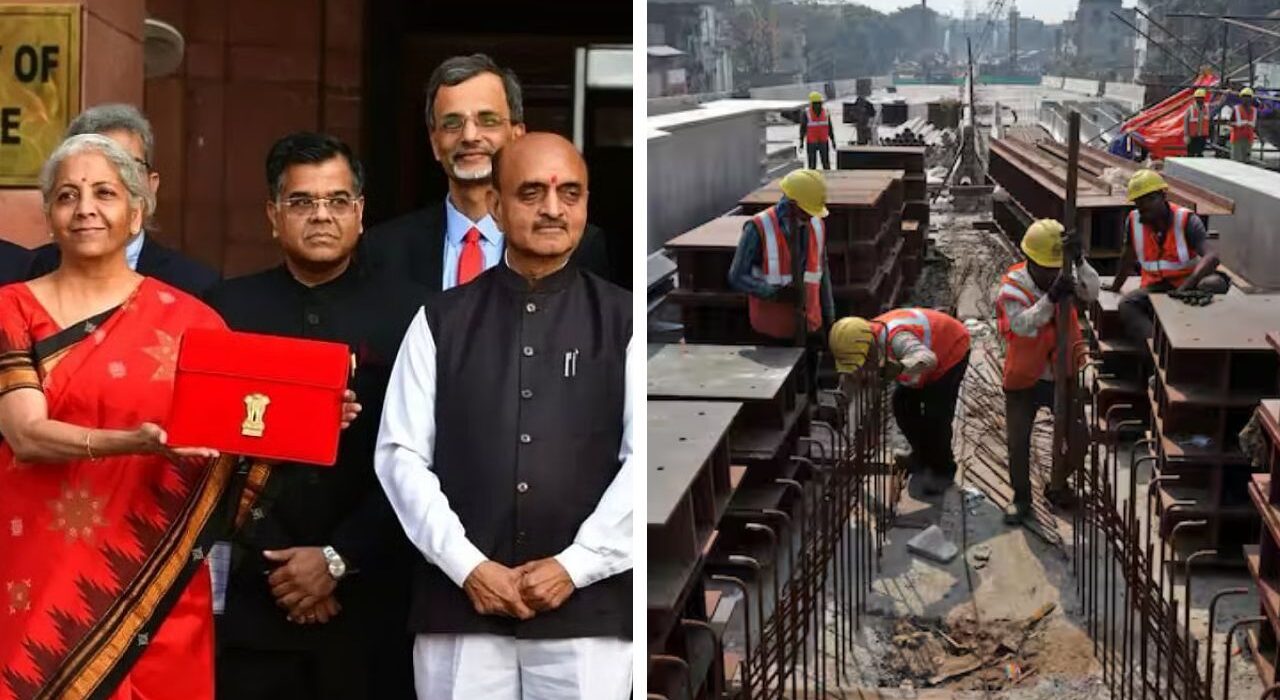

The Union Budget 2026- 27 will focus mainly on infrastructure spending and structural reforms. This comes even as global political uncertainty, trade tensions with the US, and slowing private investment create new challenges, according to a report by PL Capital.

Budget 2026 focus on Infra and Structural Growth of India

India enters the Budget season still holding the title of the world’s fastest-growing large economy, ranking fourth globally by GDP size. FY26 has seen several positive macroeconomic developments, including multi-year low inflation, cumulative interest rate cuts of 125 basis points, income tax rate reductions, GST changes, and a normal monsoon.

These factors have driven strong economic momentum. GDP growth for FY26 estimated to between 7% and 7.3% despite tough US tariffs and external pressures.

However, PL Capital believes there will not be any major announcements in the upcoming Budget 2026-2027, following last year’s sweeping tax reforms. Instead, the government is likely to focus on sustaining growth through small, targeted reforms and capital spending.

GDP growth

The brokerage firm points out a temporary slowdown in growth, projecting India’s GDP to drop to 6.4% in FY25, the weakest in four years. This decline stems from low private investment, a slowdown in manufacturing, and pressures from the global economy.

A recovery expected in FY26, with growth forecasted at 6.5% to 6.8%. This rebound supported by government spending, easier monetary policy, and improving consumer demand.