2023 kicked off on a fresh and positive note for several cryptocurrencies. After witnessing the downfall in the last year, most of such tokens are on the path to recovery. That being said, we can still say that prices are extremely low when compared to their all-time highs, which was seen in the 2021 bull run. So, let us understand how the 2H of 2023 looks like. Will these tokens be able to reach fresh highs and recover all such losses faced in 2022 or will this be a year of slow growth?

Is now the right time to invest in cryptocurrency? What all factors come into play when one considers for making an investment in cryptocurrency? Before jumping to any conclusion, let us understand what investors in cryptocurrency should know.

What you should know before making investment in cryptocurrency?

Before making an investment in cryptocurrency, it is very important to know how the value of these assets are derived.

Investors are required to find a clear distinction between “fiat currencies” and “decentralized crypto”. Fiat currency is being argued as a scam because it is being government-controlled and is deflatable at will by the policies of central bank. There are people who believe that crypto is nothing but a pump & dump scheme and this will end in disaster. The main reason behind this view is that there is no fundamental value attached to any particular crypto.

Of course, both are extreme views and neither of them is true. We believe that value of any particular currency is derived only by consensus, just like in any particular security. What is the correct price of Apple Inc. (NASDAQ: AAPL)? Of course, there is no correct price! The correct price will be the one which investors will agree to pay each another. Analysts and market experts are mere opinion-givers as they give opinions about what investors might agree to pay each other in the future. Investors may invest or trade on the basis of that opinion.

Therefore, it’s simple! Cryptocurrencies have their value because somebody is saying so.

Crypto market- What’s going on?

Entire crypto market continues to trade in a limited range. Since the collapse of FTX in the prior year, the trust on these tokens have been significantly deteriorated and the entire market crashed, with no signs of recovery. However, 2023 provided a fresh start to big digital currencies such as Bitcoin and Ethereum. Crypto market showed some signs of improvement as a result of relaxed macroeconomic situation and slowing inflation.

Now, the recent development between Binance and SEC shook the entire crypto market yet again. As a result, we have all seen bloodbath across cryptocurrencies. Looking at the current volume in digital market, it is pegged at ~$1.2 trillion. The 2 largest currencies, BTC and ETH, continue to show some recovery signs. Binance’s token, BNB, has also seen some recovery over the past few days.

BNB was pressured in the previous month after the news related to lawsuit and charges filed by the SEC broke out. Regulator alleged that Binance misused customer’s money and used that money as per their own discretion. The Securities and Exchange Commission blamed that the company tried to evade the U.S. securities law so that HNI U.S. investors continue to use their platform.

Experts in the crypto market are of the view that current situation seems difficult and the recovery can take quite some time. Most currencies lag behind their all-time highs.

The silver lining is that the crypto market has responded positively to global financial challenges and this market has been able to stay strong despite the worsening of credit conditions and bond market volatility.

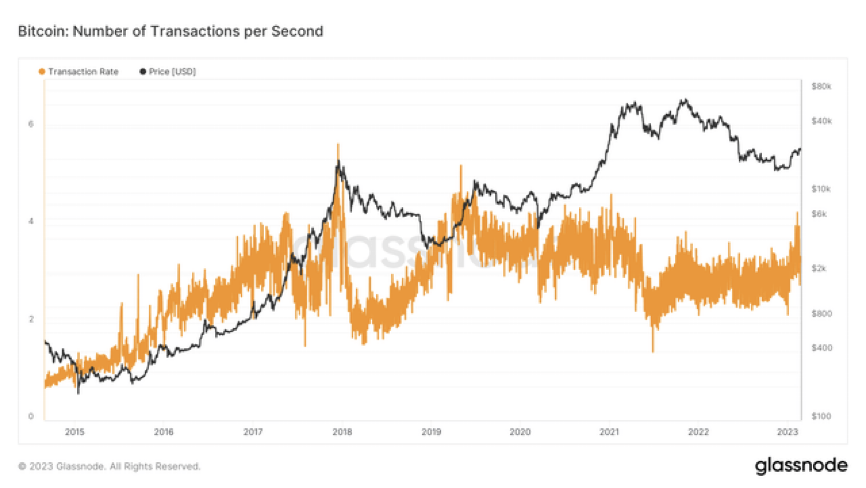

Rise in fees in Bitcoin network

One critical factor which points to the transition of the crypto industry from bearish cycle to bullish one is a rise in average transaction fee in the Bitcoin network. Rise in commissions has been seen because of higher number of transactions in the Bitcoin network. Therefore, competition continues to intensify. Crypto miners continue to select transactions having higher fees to maximize their revenues.

Source: Author’s discretion, Glassnode

Over the past few quarters, this industry has seen some tough times. In October 2022, there were reports claiming that hackers have hacked the blockchain which is associated with Binance. As a result, they stole ~$566 million in BNB, Ethereum,etc.

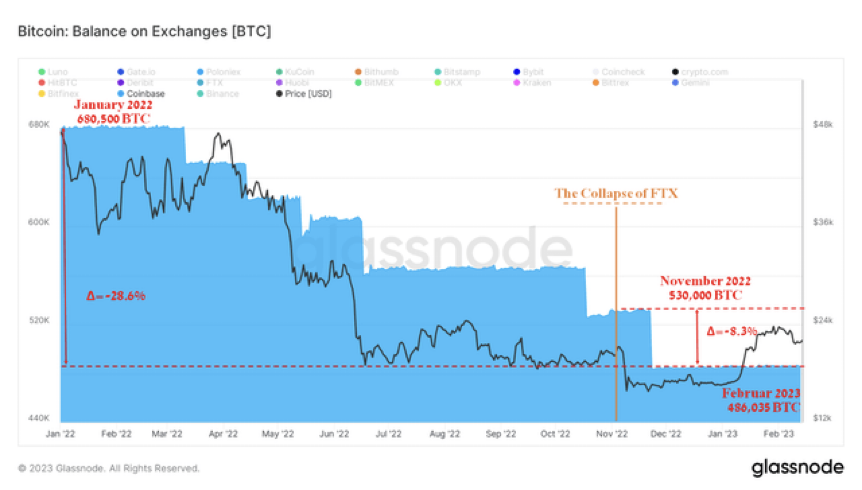

At the start of 2023, FTX announced that $415 million of digital assets have been stolen. Therefore, investors were having second thoughts in holding Bitcoins, and other coins. This prompted them to move to more secure crypto wallets. Even now, many clients favour keeping assets under their own control.

On November 22, 2022, total number of Bitcoins controlled by Coinbase stood at ~531,242. The next day there was a significant withdrawal of funds in excess of 44,000 BTC. This happened because there were reports regarding bankruptcy of FTX. The following image clearly shows the impact:

Source: Glassnode

Will Bitcoin rise in 2023?

Bitcoin is on a path to recovery, given the recent rise in the token over the previous 1 week. Bitcoin, after seeing an unstable flow in May as a result of several micro and macro factors, is finally trading in green. Despite the volatile nature of Bitcoin, there are factors like weakening of dollar, cooling inflation data, pause in rate hikes and optimism from BlackRock’s ETF filing which have jointly led to the Bitcoin recovery.

Crypto experts are of the view that if BTC stays at its resistance level of $27,700, then it can experience a bounce back from this level. However, breaking the same level can lead BTC to the lowest of $30,000 levels.

This year BTC has gone up by 80% as compared to the prior year levels. The road to recovery seems to be long, as BTC is down ~50%, from its all-time high.

When 2023 kicked off, BTC fell under the levels of $20,000. However, factors including deepening of banking crisis, dollar index weakening and cooling inflation data helped Bitcoin and other digital currencies. So, the recent financial turmoil enhanced the appetite for cryptocurrencies.

Is Cryptocurrency a Safe Investment Choice for Investors?

Cryptocurrency market has been through a lot of ups and downs. This market has seen after-effects of Russia-Ukraine war, stricter tax regulations and then the fallout of FTX. Literally, this market has gone through the toughest storms in the past few years. However, the market has recovered strongly every time on the normalisation of the situation. In 2023, crypto market saw some signs of recovery and fresh start.

Experts of cryptocurrency market view that in the current scenario, seasoned investors should make investment in stable and firm digital coins like Bitcoin or Ethereum in the SIP format. This is because these tokens have a proven track of strong recovery and these currencies are much more stable and less volatile as compared to other cryptocurrencies. However, investors are required to give ~8-10% exposure to cryptocurrencies in overall portfolio. That being said, risk appetite should also be given due weightage.

A minimum of 2 cryptocurrencies are expected to survive and probably prosper over the long term. Undoubtedly, Bitcoin and Ether are 2 tokens which we are talking about. Investors believe that Bitcoin is the only cryptocurrency which is closest to the gold standard amongst the list of several other cryptos.

Final take

After months of bear market, the first strong signs of its recovery finally appeared. In the bearish cycle, there was redistribution of Bitcoin ownership. Therefore, less disciplined and less confident investors in the digital currency tend to hand over their holdings to those who understand the value of cryptocurrencies in this digital world.

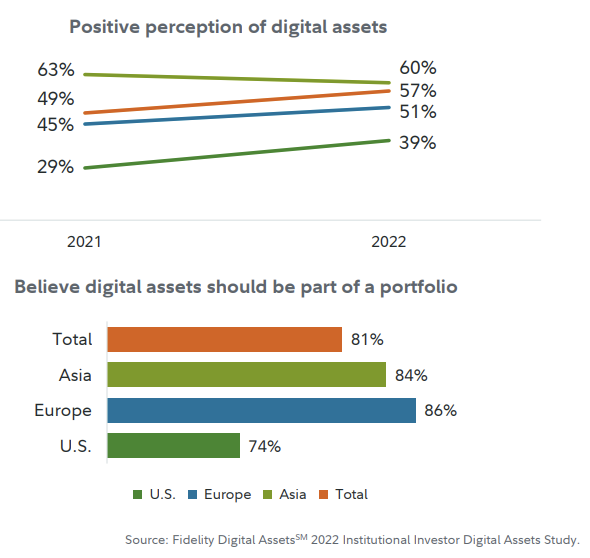

As per the report by Fidelity Digital Assets, European and American institutional investors have improved upon their perception of cryptocurrencies. As a result, they continue to increase investment in several digital assets. Experts believe that, in 2023, there can be tightening of regulation by several government agencies. While this can reduce appetite of speculative traders, it can attract attention of long-term investors.

Source: Fidelity Digital Assets

Read Also:

1 Comment