During the US-China trade war, when the world economy is slowing down, there are some countries that are benefiting the most from this trade war. According to a recent report by the United Nations Conference on Trade and Development (UNCTAD), Taiwan is gaining the most “trade diversion effect” with a windfall of $4.2 billion, which is higher than any other market.

U.N. trade and investment agencies stated that Taiwan has achieved growth in most office machinery and communications equipment businesses. The business in office machinery, including tech hardware, totaled more than $2.8 billion.

The island that became a manufacturing powerhouse decades ago is absorbing extra hefty shares diverted capital because of its mature tech industry with ample local talent, and historic business ties to China, including a shared supply chain. There were most of the Taiwanese firms already shifting operations back to Taiwan from China before the trade dispute erupted.

An economist Edward Gardner, European forecasting firm FocusEconomics says

“Taiwan is in a prime position to benefit from the trade diversionary effects of the U.S.-China trade war,”. “This is partly because of its geographical proximity to, and close trade links with mainland China.”

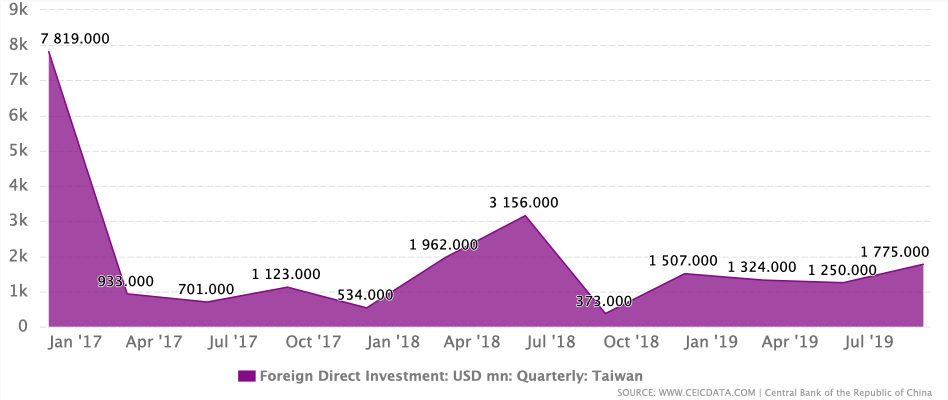

Taiwan’s foreign direct investment portfolio

Taiwan’s Foreign Direct Investment (FDI) increased by 1.8 USD bn in Sep 2019, compared with an increase of 1.2 USD bn in the previous quarter. The data reached an all-time high of 7.8 USD bn in Dec 2016 and a record low of -2.3 USD bn in Mar 2011.

The latest Current Account recorded a surplus of 12.5 USD bn in Sep 2019. Taiwan’s Direct Investment Abroad expanded by 2.3 USD bn in Sep 2019. It’s Foreign Portfolio Investment fell by 3.7 USD bn in Sep 2019. The country’s Nominal GDP was recorded at 146.3 USD bn in Jun 2019.

But the country’s foreign direct investment (FDI) increased by 1.775 USD bn in Sep 2019.

Taiwan’s approved foreign investment from China was recorded at 3.258 USD mn in Oct 2019. This records a decrease from the previous number of 10.580 USD mn for Sep 2019. The data reached an all-time high of 152.793 USD mn in Dec 2012 and a record low of 0.000 USD mn in Nov 2009.

Whereas, Hong Kong data was recorded at a high 62.354 USD mn in Oct 2019, compared with an increase of 27.399 USD mn in the last month of Sep 2019. Subsequently, Japan was recorded at 42.467 USD mn and USA data was recorded at 12.159 USD mn in Oct 2019.

Where Information & Communication is one of the highest investment sectors recorded at 815.462 USD mn in Oct 2019 while it was recorded at 46.828 USD mn for Sep 2019. The data reached an all-time high of 1.045 USD bn in Dec 2017 and a record low of 0.000 USD mn in Feb 2008.

Whereas the Finance and Insurance sector was recorded at 184.181 USD mn in Oct 2019. This records a decrease from the previous number of 191.560 USD mn for Sep 2019. Wholesale & Retail Trade industry data was recorded at 131.562 USD mn in Oct 2019. And, the Real Estate industry and Manufacturing were recorded at 68.719 USD mn and 71.456 USD mn in Oct 2019.

In addition, the country has an external debt of 191.9 USD bn in Sep 2019, compared with 187.2 USD bn in the previous quarter.

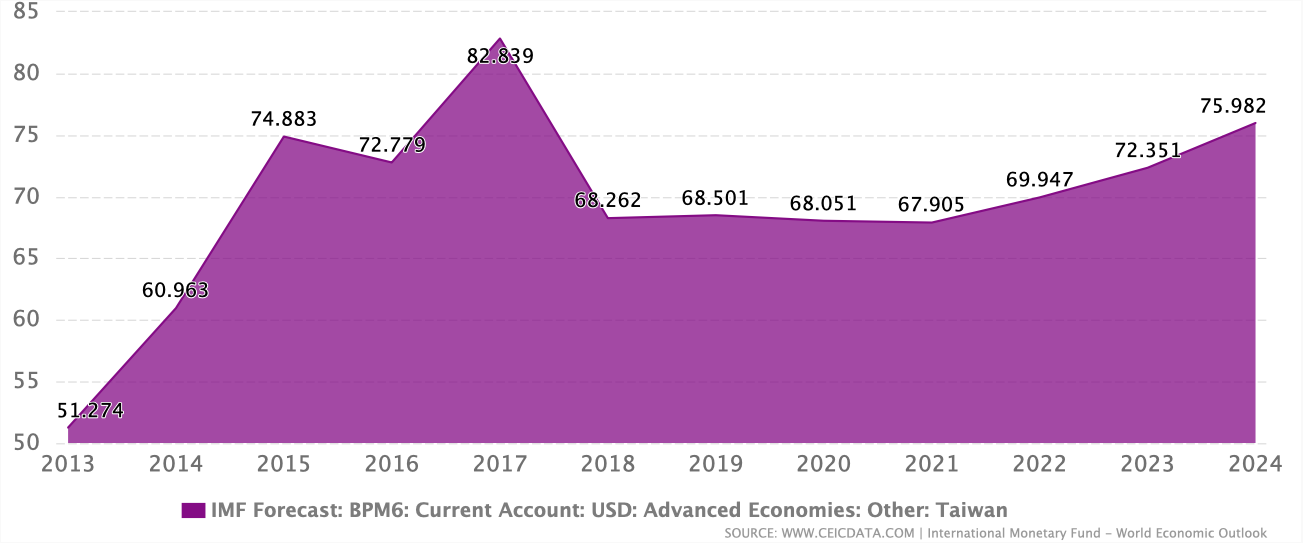

Taiwan’s Current Account Balance is forecasted to be 67.024 USD bn in Dec 2019 as recorded by the International Monetary Fund – World Economic Outlook.

It records a decrease from the last recorded number of 71.989 USD bn in Dec 2018. Looking ahead, Taiwan’s Current Account Balance is projected to stand at 59.948 USD bn in Dec 2024.

Based on the above data and forecast report, the future growth of the country is still in difficulty. But the factors are given below clearly indicate that there may be rapid foreign investment in the country from the USA, Japan, Hong Kong, etc. in the future.

Taiwan edges out the rest of the world

Chinese exports to the U.S. Market has lost $35 billion trade dispute. It is estimated that 63% of the total was diverted to other countries and territories, and the rest was either lost outright or absorbed by American producers.

It put Mexico in second place after Taiwan, with trade diversion there worth $3.5 billion, and the European Union in third place with a diversion sum of $2.7 billion.

These shifts signal that multinationals are looking for a “diversification” of risks away from China.

The U.S.-China trade war broke out in March 2018 when U.S. President Donald Trump has signed a memorandum ordering the first round of tariffs on Chinese imports. There is a total of $550 billion tariffs on Chinese goods now, and China has hit back with duties on U.S. goods worth $185 billion.

Related: China’s economic growth slips to a 17-year low in August

Taiwanese manufacturers moving their production back home

Taiwanese investors in China had already been scaling back their China operations before the dispute broke out. They had grappled in China for the past decade with rising labor costs, intellectual property violations and problems with workplace productivity.

Taiwan’s New Kinpo Group has been shifting its manufacturing operations out of China for years, a move that’s said to be paying off now as the world’s two largest economies slap tariffs on one another.

Investors from other countries like Japan and South Korea have opened factories in China over the decades to capitalize on lower labor costs, a skilled workforce and a giant domestic market. But Korean and Japanese electronics firms had already built a “relatively diversified overseas supply chain”, meaning they can lean on their non-Chinese factories for more help during the trade dispute.

Another example, Taiwanese electronics firms that were highly reliant on China as their primary production base, are now moving their production back home due to increasing U.S. tariffs on China-made products.

About 142 Taiwanese investors had repatriated NT$610 billion from China back to Taiwan in October, government-supported Central News Agency reports. That figure has been climbing throughout the trade dispute.

Industries coming back home will help in increasing the wealth or GDP of the country.

Related: China no longer US top trading partner – says media report

Skilled tech workforce, mature supply chain

Taiwan benefiting the most because it’s economy largely relies on tech hardware such as semiconductors and new gear for 5G wireless protocol.

The report says

“About 60% of the 10 million employs in mainland China work in information and communication technology industry.”

For Taiwan companies that perhaps have facilities in China, it does make sense to say ‘let’s bring them back home,’ so made-in-China is Made-in-Taiwan.

Supply chain overlaps between Taiwan and China make it particularly easy for Taiwanese electronic component manufacturers to return to shore. Taiwan government initiatives such as preferential financing and permission to hire low-cost foreign workers “further entice manufacturers to base operations in Taiwan.”

Experts believe that the world’s biggest contract chipmaker ‘Taiwan Semiconductor Manufacturing Co.’ could pick up a lot of this diversion. The company’s second-quarter revenue of NT $241 billion that was 10.2% ($7.9 billion) up over the first quarter and 3.3% over the April-June period of 2018.

Taiwan’s tech talent attracting American investors

Last month Google announced it will hire 300 people in Taiwan this year, and train 5,000 students in Artificial Intelligence for machines.

Separately but in the same thematic vein, Microsoft said in January it had picked Taiwan to grow its artificial intelligence business. The software firm that’s best known for its Windows operating systems added last month that it would recruit 100 people in the next two years and 200 within five years for a $34 million Taiwan R&D center now in the works.

And that wasn’t the end of Taiwan’s fortune. Last month the Taiwan general manager of IBM said her firm would expand its R&D center in Taiwan with eyes on artificial intelligence, blockchain technology, and cloud computing. The manager anticipated 100 new hires in 2018. It’s also developing a cloud research lab in Taiwan.

All three investment cases originated with major American high-tech firms. All reached Taiwan. It’s because Taiwan suddenly has what they want.

There’s no lack of hardware as well as soft talent that these institutions can take advantage of. Taiwan has some of the best talents around the region, and it comes cheap as well. If you want to establish a data center to be located in Northeast Asia, Taiwan looks attractive.

Conclusion

The Taiwan conditions that motivated investments by Google, IBM and Microsoft may attract others over time. Taiwan still confuses some investors because of complex time-off-from-work rules, but more investors will probably consider expanding in Taiwan “case to case.”

Taiwan is looking for new high-tech fields to grow its GDP to a target of $613 billion economies this year, without over-reliance on hardware manufacturing. This comes as a preemptive move as hardware firms increasingly find they can do factory work for less offshore.

Latest Articles: