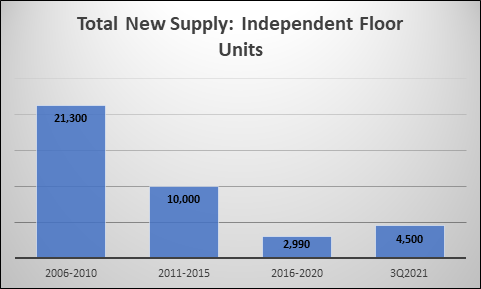

- Millennium City & Faridabad together to add more than 20k independent floors units over next 1 year amid high demand; nearly 4,500 independent floor units already launched b/w Jan.-Sept. 2021 in both cities

- Haryana’s Deen Dayal Jan Awas Yojna scheme which allows developers to build independent flats up to 4 floors to sell individually has attracted players with landbanks to obtain licenses

- Leading developers include DLF Ltd, M3M, Trehan, Signature Global, BPTP & Raheja, among others

- 2016-2020 period saw lowest new supply (just 2,990 units) of independent flats in the 2 Haryana cities; 2006-2010 saw nearly 21,300 units launched while 2011-2015 period added approx. 10,000 independent floor homes

- At 2000 sq,ft., avg. size of independent/builder floor flats is higher than 1,350 sq. ft. of apartments

New Delhi, 12 October 2021: Haryana’s top cities Gurugram and Faridabad are seeing a major housing market trend reversal, with independent floors gaining traction post the pandemic. Developers are lining up for launching independent floor homes in both these NCR cities – over 20,000 independent floor flats are expected to be launched in both the cities in the next one year.

Santhosh Kumar, Vice Chairman – ANAROCK Group says, “As many as 4,500 independent flats have already been launched in Gurugram and Faridabad in the first three quarters of 2021 – accounting for over a 40% share of this period’s total supply in these two cities. Approx. 10,970 units across different property types have been launched in Gurugram and Faridabad between January to September 2021, of which 4,500 units are independent floor units.”

Demand & Supply Dynamics: Independent Floors

The concept of independent floor homes as a property type is not new in Gurugram and Faridabad, and existed much before the pandemic. In retrospect:

- Between 2006 and 2010, these two Haryana cities added nearly 21,300 independent floor units.

- Supply of independent floor homes dropped by more than 50% to approx. 10,000 units between 2011-2015, when high-rise apartments started gaining prominence.

- Between 2016-2020, the overall new supply of independent floors dropped even further – by 73% against preceding period – with just 2,990 units being added.

“Changing buyer preferences due to the pandemic and the Haryana government’s Deen Dayal Jan Awas Yojna scheme,” says Santhosh Kumar. “Under this scheme, developers can build independent flats up to four floors and sell them individually. Many developers with land banks in these cities are now lining up for license to construct independent floor homes.”

Earlier, independent floors were typically developed by local NCR developers; today, branded players like DLF Ltd, M3M, Trehan, Signature Global, BPTP and Raheja are in the fray.

A major motivator is the fact that the development turnaround time for independent flats is faster than high-rises, providing an opportunity for faster monetisation. Also, money generated from builder floors starts flowing in within one year, while high-rises take at least four years to pay off.

Demand Drivers

Homebuyers today are keen on quick possession. The possession time for independent floors is significantly shorter than for multi-storey apartments. Builder floors are also gaining popularity because they combine the benefits of both traditional apartments and villas. With one flat typically constructed on a single floor, occupying families have more space and privacy in this property typology than in high-rise apartments.

The average size of independent/builder floor flats outstrips that of apartments, and the average sizes have been increasing over the period. In contrast, apartment sizes were shrinking until 2021 (post the pandemic).

- The average size of a builder floor flat is presently 2,000 sq. ft. while that of an apartment is 1,375 sq. ft. – a difference of 625 sq. ft. Post COVID-19, buyers prefer bigger spaces and get them in independent floors.

- In the 2006-2010 period, the avg. size of builder floors was almost the same as that of apartments at 1,585 sq. ft. for the former and approx. 1,500 sq. ft. for the latter.

- In the 2011-2015 period, avg. size of apartments remained more or less the same at 1,475 sq. ft. while that of independent floors increased to 1,800 sq. ft.

- Between 2016 and 2020, avg. size of apartments reduced further to 1,350 sq. ft. while that of independent floors increased to 1,925 sq. ft.

|

Avg. Sizes (in Sq. Ft.): Apartment Vs Independent Floors | ||||

|

|

2006-2010 |

2011-2015 |

2016-2020 |

2021 |

|

Apartment |

1,500 |

1,475 |

1,350 |

1,375 |

|

Independent Floors |

1,585 |

1,800 |

1,925 |

2,000 |

Since builder floor developers cater to a smaller group of buyers, they can provide a premium luxury offering. Builder floors typically incorporate large balconies and windows, high-quality pre-built wardrobes and cupboards, as well the electrical and plumbing fittings are invariably superior to those of apartments.

Also Read: Top 7 Cities See 113% Increase in Housing Sales in Q3 2021, New Launches…

1 Comment