Inflation is slowly falling, but economic growth continues to be at historical lows. Apart from this, financial risks have increased. That being said, the global economy’s systematic recovery from both pandemic and Russia-Ukraine war remains on track. Much of this support comes from China as the country’s economy continues to rebound strongly. Supply chain disruptions continue to reduce, while dislocations and challenges caused by geopolitical tensions are receding.

Simultaneously, central banks’ move of massive and synchronized tightening of monetary policy should start to bear fruit, with inflation getting back to target levels. Experts believe that growth should bottom out at 2.8% in the current fiscal before increasing modestly to 3% in next year, 0.1% below January projections. They also suggest that global inflation will decline. However, the pace of this decline can be slow than initially anticipated, from 8.7% last year to 7% this year and 4.9% in the next year.

United States

Market indices continue to reach highs on calming inflation fears.

Favorable inflation and growth signals seem to help stocks continue a rally that began with only a few interruptions in late May. The S&P 500 Index was able to notch its longest stretch of daily gains since November 2021. The index also saw best weekly performance since end of March.

Several signs hinted that the US economy was enjoying a “Goldilocks” expansion of continued growth and falling inflation. Recently, the Labor Department made an announcement that consumer price index increased at a year-over-year pace of 4.0%. This increase was down from prior month’s 4.9% and slowest pace since March 2021. On Thursday, the Labor Department unveiled that producer prices declined 0.3% in May, marking 4 declines in previous six months.

While decline in producer prices exhibited an ongoing contraction in the manufacturing sector, there was some good news on the consumer side of the economy. Overall, retail sales grew 0.3% for the month and 1.6% in 12 months, marking the first year-over-year increase since January month.

Hopeful inflation data could have helped investors absorb hawkish outlook from Fed policymakers. On Wednesday, policymakers announced about holding the official federal funds target rate steady in between 5.00%-5.25%. However, the “dot plot”, which summarizes each policymaker’s rate expectations, exhibited that this was more of a “skip” rather than durable “pause” in rate-hiking schedule. This is because median rate projection suggested 2 more quarter-point hikes by year end.

Europe

In terms of local currency, the pan-European STOXX Europe 600 Index advanced 1.47%. Much of this advance came as a result of U.S. Federal Reserve refraining from raising rates this month. Apart from this, hopes that China could implement stimulus measures might have helped this rally. All other major equity indexes also advanced. Germany’s DAX advanced 2.56%, France’s CAC 40 Index increased 2.43%, and Italy’s FTSE MIB increased 2.58%. The UK’s FTSE 100 Index was able to add 1.06%.

The 10-year German government bond yield climbed over 2.5% after the ECB raised interest rates and signaled that there are chances of a tightening monetary policy. Swiss and French yields trended higher too.

ECB increased its key deposit rate by a quarter-point to 3.5%. This marks the highest level in around 22 years. ECB President mentioned that policymakers “still have ground to cover,” hinting that a further tightening is in the offing, unless there seems to be a “material change in the baseline outlook.”

The European Central Bank raised its forecasts for headline and core inflation throughout 3-year time horizon. This further strengthens the case for tightening of monetary policy.

India

MPC unanimously reached a decision to keep policy repo rate unchanged at 6.50%. Consequently, the standing deposit facility (SDF) rate stayed at 6.25% and the marginal standing facility (MSF) rate and the Bank Rate stayed at 6.75%. With policy repo rate at 6.50% and full-year projected inflation for 2023-24 at just a little more than 5%, the real policy rate seems to be positive.

Turning to 2023-24, domestic demand conditions are still supportive of growth due to improved household consumption and investment activity. Urban demand continues to be resilient, with indicators like passenger vehicle sales, domestic air passenger traffic, and credit cards outstanding showing double-digit expansion on YoY basis in the month of April.

Looking ahead, higher rabi crop production, expectations about normal monsoon, continued buoyancy in services and softening of inflation should help household consumption. On the contrary, given healthy twin balance sheets of banks and corporates, normalisation of supply chain and declining uncertainty, there could be momentum for the capex cycle. Taking such factors into consideration, real GDP growth for 2023-24 has been pegged at 6.5% with 1Q24 at 8.0%, 2Q at 6.5%, 3Q at 6.0%, and 4Q at 5.7%, with risks evenly balanced.

Futuristic views on global economies and impact of inflation

With end of pandemic-related restrictions, the composition of consumer spending shifted back to services. As a result, there has been a pick-up in travel, food services, recreation, healthcare and personal services. As and when pent-up demand gets satisfied, spending on services is expected to decelerate in the next year.

Global CPI is expected to slow from 7.6% in 2022 to 5.6% in 2023 and 3.5% in 2024. As a result of improved supply chain conditions, increased interest rates, and weaker demand for goods, commodity prices might shift downward through mid-2024. Services price inflation is expected to be more persistent as a result of labor shortages, pent-up demand, and capacity reductions.

US Federal Reserve decided against increasing the interest rates on 14 June for the first time since its push to tame spiking inflation started over a year ago. Experts believe that this pause might be short-lived. Central bank has signaled that it will resume increasing interest rates in July and push them higher than anticipated previously. Median forecast among Fed officials shows the benchmark federal funds rate to hit 5.6% by 2023 end, roughly 50 bps higher than the current level.

June pause should help experts to assess inflation, jobs and other critical economic data before going for another hike in July meeting of rate-setting FOMC. The fresh projection, which is an increase from prior quarterly predictions, hints that another aggressive monetary policy tightening cycle in history has some room.

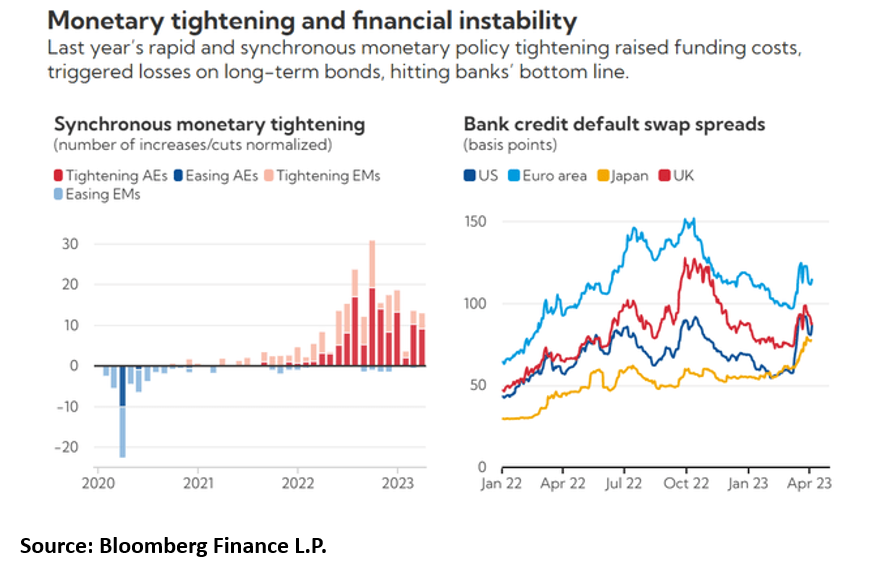

Panic situation among investors is a side effect that sharp monetary policy tightening of the last year might have on the financial sector. After prolonged period of muted inflation and low interest rates, financial sector became too complacent regarding maturity and liquidity mismatches. Rapid tightening of monetary policy resulted in sizable losses on long-term fixed-income assets and higher funding costs.

Financial system can again be tested even more. Nervous and risk-averse investors tend to look for next weakest link, like they did with Crédit Suisse. Financial institutions which have excess leverage, higher interest rate exposure, or significant dependency on short-term funding can become the next target.

More than ever, policymakers should have a steady hand and clear communication. Since financial instability has been contained to some extent, monetary policy is expected to be focused on bringing inflation down. However, policy should quickly be adjusted to financial developments. A silver lining is that recent banking slowdown is expected to slow aggregate activity as banks continue to curtail lending. This might actually partially mitigate requirement for further monetary tightening to achieve same policy stance. However, if central banks prematurely surrender themselves to this inflation fight, it might lead to an opposite effect i.e., lower yields, and finally complicating task of policymakers.

S&P Global’s PMI™ surveys exhibit that India continues to lead all major economies with strong growth in both services and manufacturing. Even though growth in Taiwan, South Korea, and Australia slowed markedly, expansions in Vietnam, the Philippines, and Indonesia are expected to remain robust. China’s economic data through April provides us with some sort of mixed signals: services output and retail sales rebounded strongly after removal of zero-COVID policies, surpassing subdued growth in fixed investment and exports. Post 3.0% growth in 2022, experts believe that mainland China’s real GDP should increase 5.5% in 2023 before a long-term deceleration.

Final take

Expansion of global economy is expected to proceed at a moderate pace, led by service sectors. Economic performance is expected to vary across sectors and regions, with Europe and the Americas going through sluggish growth and some parts of Asia-Pacific experiencing healthy expansions.

Since commodity prices are expected to be on a downward path and there can be some easing of supply constraints, inflation should diminish, enabling monetary policies to ease in 2024-25.

Read Also:

2 Comments