A rate hike was expected, but the expectation was for a maximum of 35 bps. The hike by 50 bps is definitely on the higher side, and home loan lending rates will now edge further into the red zone.

This is the third consecutive rate hike in the last two months and finally marks the end of the all-time best low-interest rates regime – one of the major factors that drove housing sales across the country since the pandemic. This whammy comes along with the inflationary trends of primary raw materials, including cement, steel, labour, etc., that have recently led to a rise in property prices. Together, these factors – rising home loan rates and construction costs – will impact residential sales that did reasonably well in the first half of 2022. As per ANAROCK Research, approx. 1.85 lakh units were sold in H1 2022 across the top 7 cities.

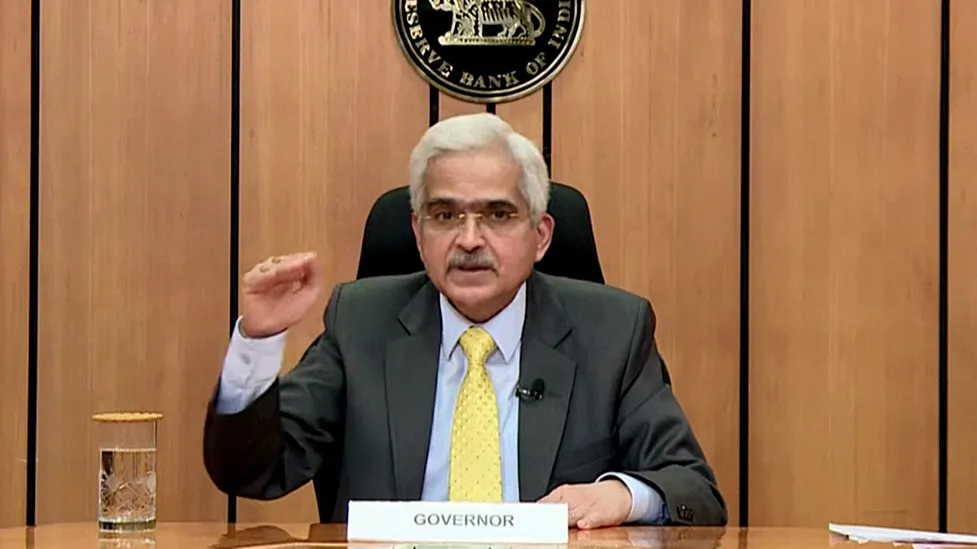

The repo rate now stands at 5.4%, thus reaching the pre-pandemic levels. While inflation has partially eased as compared to the surge in April, it continues to be above the RBI’s target.

Recent borrowers who have taken home loans before April would feel the most impact as the rates are expected to rise from 6.5 – 7% to around 8%. For instance, if you have already taken a home loan of ₹30 lakh at 7% for a tenure of 20 years, your EMI will go from ₹23259 to ₹25093, a jump of ₹1834, if the home loan interest rate climbs from 7% to 8%.

To mitigate the effect of this rate hike, existing borrowers can use techniques like balance transfer or prepayment options to reduce their loan burden.

See Also:

2 Comments