The housing market is a significant part of the economy in India, especially given its large population. The demand for new housing comes with the increasing demand for affordable loans. Lending institutions like state-owned banks account for over 60% of the credit provided, while privately owned banks have been able to grow their share by offering quicker and easier loan turnaround periods. Despite charging higher interest rates, private banks have been able to capture a 30% share of the business.

Housing Loans in India

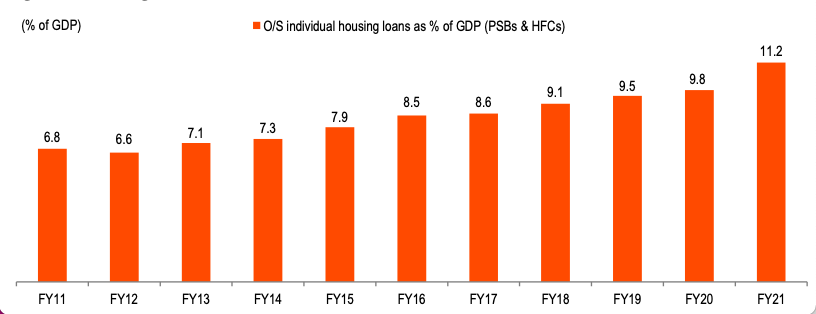

As a larger amount of home loans are being taken out in India, the ratio of this debt to GDP has grown more quickly in the last ten years. From 6.8% in FY11, this ratio reached 9.5% in FY21 and 9.8% just one year later. In FY20 on the heels of an economic shock, the ratio rose to 9.8%. Despite these hurdles, by the time that happened, it had already recovered from a pandemic and increased to 11.2%.

Housing loans as % of India’s GDP

Trends in housing loans by SCBs:

SCBs’ housing loan portfolio has grown from 3.45 Crores in FY11 to 15.1 Lakh crore in FY21, at the annual conversion of 14.3%. Of the total residential loans for creating homes, SCBs hold 61.2% and private banks hold 35.2%. It is important to note that while the share of private banks dropped when compared to PSBs’ share in FY11, they have steadily increased since then. Furthermore, private banks have also maintained a healthy annual growth rate of 19.6% during this time frame.

Foreign banks have only a small share of housing loans in the market. Their share has drastically decreased as local banks have huge shares with PVBs, now accounting for more than 55% in their industry. In FY 2011, their share was about 6.4%, and by 2021 it had declined to 1.7%.

A small portion of housing loans in India are made by State Central Banks, such as Regional Rural Banks. From Rs. 5 billion in FY11, RRBs have seen their housing loan market grow to Rs. 25 billion in FY21, resulting in a 15% CAGR growth rate. More recently, Small Finance Banks have also entered the housing loan market and there is less than Rs 3 billion (0.2% of overall housing loans by State Central Banks) of SFB lending at the moment.

Overview of advancements for housing loans by NBFCs

Over the last several years, NBFCs have made significant gains in the housing loan market and now provide a reliable source of capital to this sector. In FY16, these NBFCs provided Rs.14,547 crore in gross advances to the housing sector; by FY21, this number had significantly increased to Rs. 21,478 crore and is expected to rise higher still in fiscal year 22. In H1FY22, NBFCs are already providing loans at a rapid pace, despite that this industry is with limited participation from mainstream lenders like SBI, IDBI or RBI-regulated banks.

The present scenario of Housing Finance in India

In the last few years, housing finance institutions like Housing Finance Companies (HFC) have seen a sharp increase in loan portfolio. Housing loans grew from Rs 2.6 lakh crores to Rs 7.1 lakh crores during the period of FY13 to FY21. During the same time period, HFC’s loan portfolio grew by 11.8% CAGR. HFCs have been liberalizing their lending criteria in recent months with demand for housing beginning to show signs of a rebound which has increased the HFC loan portfolio to 7.4 crores in first half of this year alone.

What’s the difference between HFCs and SCBs

From 2015-2019, SCBs have been the dominant player in the housing loan market, accounting for over 60% of outstanding loans in the last two years. An interesting thing to note is that in the last two years; From 64% in FY19, the market share for SCBs increased to 67% in FY20 and 68% in FY21. On the other hand, HFCs lost more share.

In the last 5 years, preferential housing loans by both HFCs and SCBs grew faster at the same pace. In FY17, HFCs recorded 11.9% growth in their outstanding housing loans while SCBs also saw same 11.9% growth, furthering the disparity. In FY18, when they both grew by 16.2%, SCBs had a significant increase at 20.7% while HFCs saw a much higher 20.7% more relative to that same period. When it comes to YoY growth, in FY21 and later, where SCBs saw 12.4% increase in outstanding loan growth as opposed to 8.1% for HFCs (when they started to catch up), both banks witnessed a slowing trend because of lowered production from increased lending rates .

An Analysis of the loan rates

The Weighted Average Lending Rate by HFCs is higher than that charged by SCBs. However, in this time period, both rates fluctuate in tandem as they have done historically. As the difference between WALR of HFCs and SCBs increased to above 100 bps from Jun’15 to Sep’18, the interest rates for both banks skyrocketed. This change was a result of a cut in policy rates by RBI reflecting downside risks from economic growth and the Covid-19 pandemic. On the other hand, the difference has widened more substantially over this period because SCBs are more responsive to cuts in repo rate due to external benchmarking with these changes, whereas HFCs are linked to a less responsive prime lending rate.

House loans are a fast-growing field with many state governments looking to enact credit reforms that give its residents access to affordable homeownership. A new report breaks down who these lenders serve most heavily, showing that SCBs, specifically PSBs with their vast geographical footprint, can look at the opportunities to expand their loan markets in these states by considering these HFCs as potential borrowers.

State-wise housing loan outstanding by HFCs as on 31 March 2021

| States | Mar 21 (Rs. Crore) | % Share |

| Maharashtra | 1,72,370 | 24.1 |

| Tamil Nadu | 78,167 | 10.9 |

| Karnataka | 73,420 | 10.3 |

| Uttar Pradesh | 63,302 | 8.9 |

| Telangana | 57,738 | 8.1 |

| Gujarat | 49,629 | 6.9 |

| Rajasthan | 30,755 | 4.3 |

| Haryana | 29,521 | 4.1 |

| Delhi | 26,292 | 3.7 |

| Madhya Pradesh | 24,734 | 3.5 |

| Total | 7,14,379 | 100 |

Latest update on India’s housing prices

In the chart below, we can see that housing loans are impacted by housing prices. The change in outstanding loans for SCBs tracks with the change in inflation for housing prices as tracked by RBI’s Micro-Level Estimates on HPI.

Growth in outstanding credit was much higher than HPI at 12.1%, but there was also growth in the region of 14.5%.

Expect house prices to remain flat or decrease in the short-term between FY17 to FY21, despite loan growth from SCBs and HPI growth from that time frame.

Home loans bank accounts worthing around Rs 8.30 lakhs on average in the FY14-FY22 period grew to be worth Rs 15.34 lakhs by the end of this period. The number of home loan users increased over 7% per year, while outstanding bank accounts increased by a yearly growth rate of 15%. It is possible to say that, during this first phase, higher growth was aided also by steady increase in housing prices while, in the second phase, it was more due to an increasing customer base given housing index still increasing

Concluding remarks

The housing industry was the only large segment that showed resilience post pandemic. Businesses were hesitant on just how much their operations would be affected, but remained optimistic due to government support and lower prices and interest rates in the post-pandemic months. While HFCs have started to emerge as one of the biggest players in the mortgage market, HFCs account for just about a third of this segment’s revenue. Nearly all other financing types (including NBFCs and RRBs) account for another small share of these loans.

As economic activity shifts toward normalized levels and growth improves, demand for housing loans is anticipated to grow signifying a greater demand for housing. Further, higher interest rates are expected to deter some borrowers from the market but when put into perspective of individual home buyers it is possible that they may not be deterred from purchasing their homes because they have calculated the loan costs during the duration of their tenure.

See Also: Housing Market in Top 7 Cities May Scale New Peak in 2023

4 Comments