Bharti Airtel is among the top 3 mobile service providers globally in terms of subscribers. Apart from mobile services Bharti Airtel offers Telemedia and digital TV services. Airtel business provides a broad spectrum of services to Government, small & medium business, large enterprise, and carrier customers.

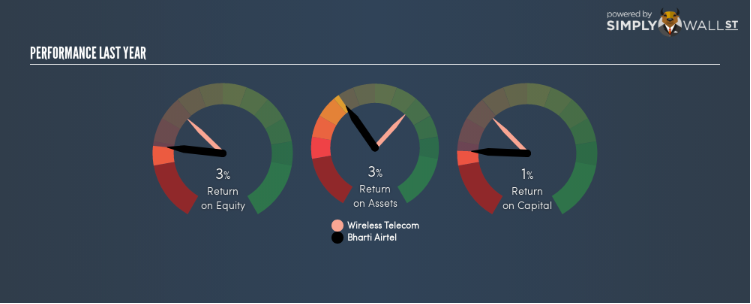

Though Bharti Airtel recorded a below-average return on equity of 2.61% in the year 2017-18, a report from Zee Business says Bharti Airtel can give 26% return to its investors in the near future.

Source: Simplywall.st

According to Economic Times, Bharti Airtel recorded a profit of Rs 86 crore for the last quarter of 2018. Also, the company recorded a net profit of Rs 306 crore during the corresponding period last year.

1 – Past Performance Of Bharti Airtel

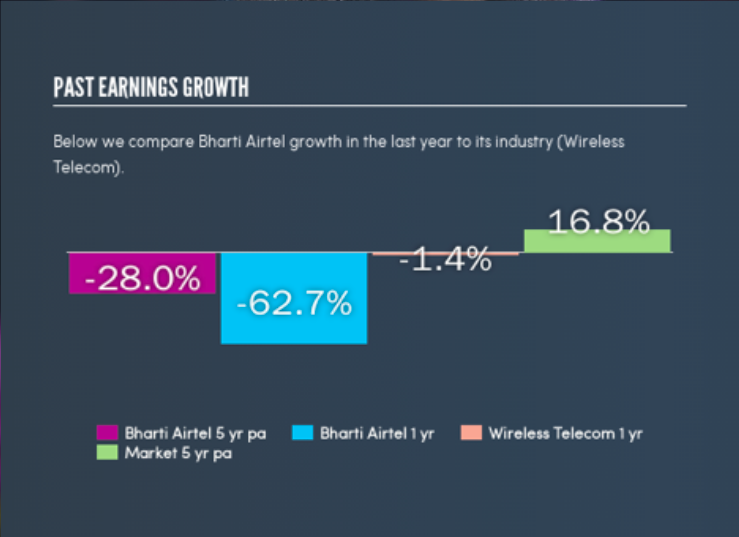

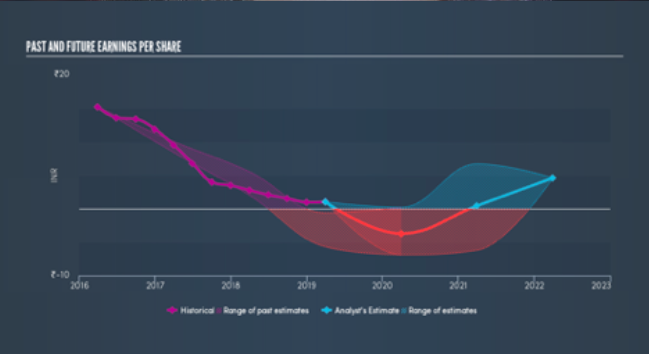

From the past five years, Bharti Airtel’s on year earnings growth was negative. According to a report by Simply Wall Street, the earnings per share has shrunk by an average of 63% annually over the last three years.

Source: Simplywall.st

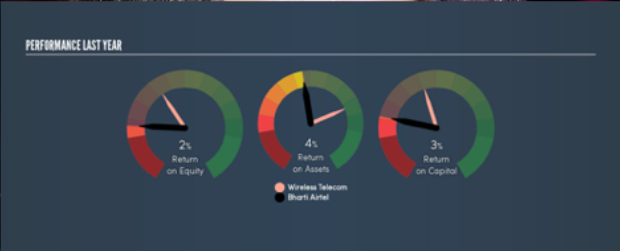

Bharti Airtel has not used the shareholders’ funds last year efficiently. The return on equity was 1.99%. Also, they used their assets less efficiently than the Asia Wireless Telecom industry average last year. The use of capital also deteriorated last year when compared the return on capital of the previous 3 years.

Source: Simplywall.st

2 – Expected Future Of Bharti Airtel

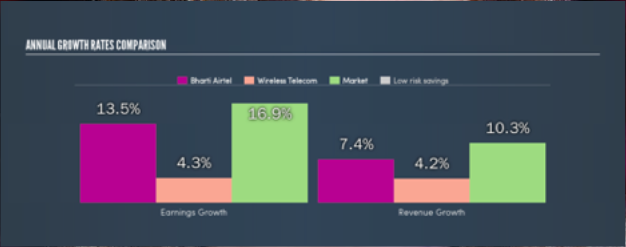

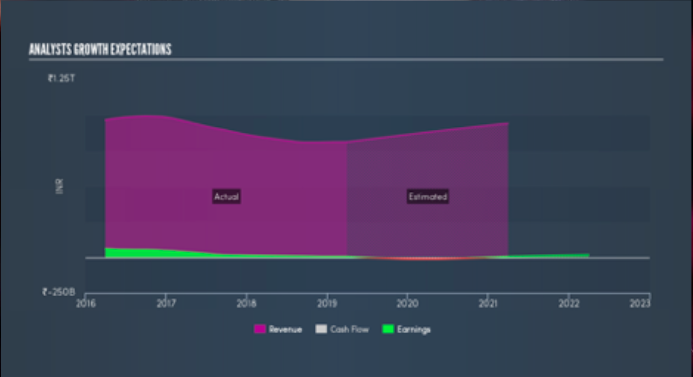

Bharti Airtel is assertive of high earnings growth in the coming years. A report from Simply Wall Street indicates that the Bharti Airtel earnings are expected to grow by 13.5%, but is not above the India market average which is 16.9%.

Source: Simplywall.st

Bharti Airtel’s revenue is expected to grow by 7.4% yearly. The annual revenue of the company is expected to reach ₹ 941,001.56 Million by the end of the financial year 2020-2021.

Source: Simplywall.st

Stock investments could be a little risky but Bharti Airtel’s earnings growth is expected to outdo the low-risk savings rate of 7.8% in the coming year.

3 – Why To Buy Bharti Airtel’s Stock Now?

The stock price seems fairly valued at the moment and if you buy a share today you would be paying a relatively fair price for it. When compared to the rest of the market, Bharti Airtel’s share price seems relatively stable.

Though the Bharti Airtel’s dividends are expected to go down to 0.94% from 1.51% by next year, the earnings per share are expected to reach ₹4.60 from ₹1.02 by the end of the financial year 2021-2022.

Source: Simplywall.st

A report from Simply Wall Street suggests that the earnings of Bharti Airtel are expected to double over the next few years which will lead to stronger cash flows and higher share values, feeding into higher ROI.

Conclusion

Airtel is planning to kick-off the IPO (Initial Public Offering) for its Africa unit. With Airtel deepening its roots outside India can increase profitability. Though Bharti Airtel stock didn’t perform well in the last three years, the future of the stock seems promising. Right now, the price of the stock is undervalued and buying it at this moment can prove beneficial in the coming years.

Related: