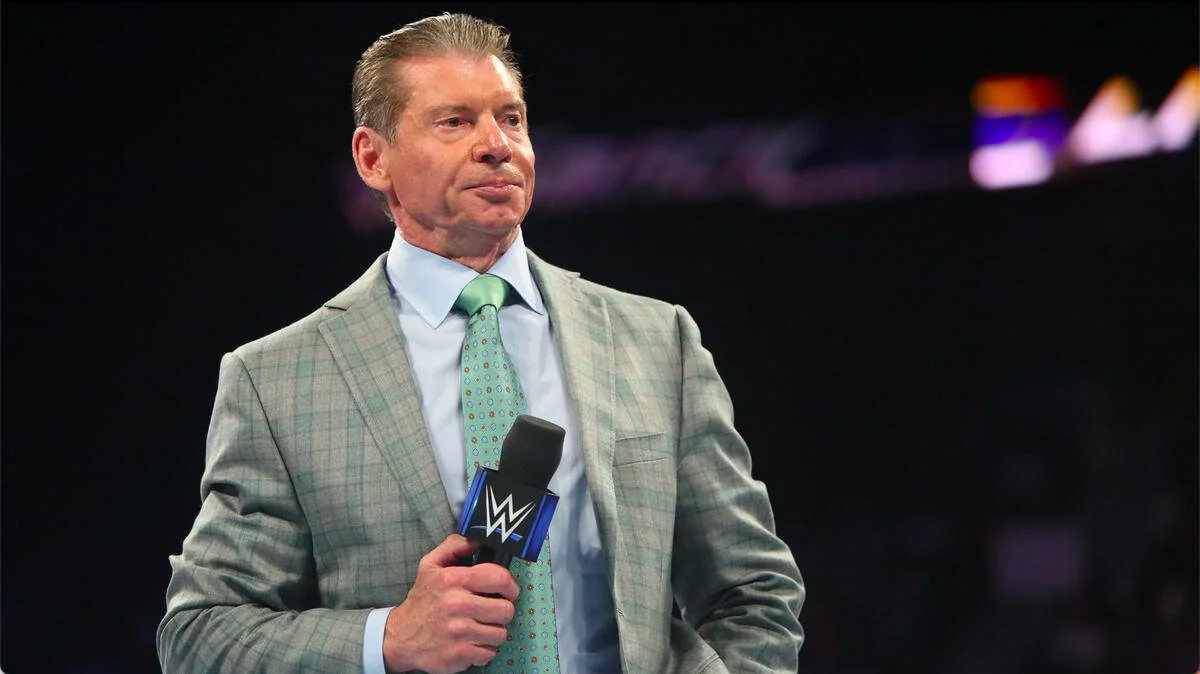

In the wake of unsubstantiated rumors of Worldwide Wrestling Entertainment(WWE) being sold to a Saudi Arabian sovereign wealth fund, the company’s shares spiked and then slipped Wednesday, even though the company’s market cap has increased nearly $2 billion since the return of its scandal-ridden billionaire boss Vince McMahon.

WWE shares soared as much as 2.5% in early trading after a viral, now-deleted report from DAZN’s Steven Muehlhausen claimed WWE had entered into an agreement to sell itself to Saudi Public Investment Fund and go private, although later reports, citing internal sources at WWE, indicated no deal was in place.

As LightShed Partners’ Rich Greenfield tweeted, the reports are 100% false, while Cannonball Research’s Vasily Karasyov wrote in an email that the original tweet has been removed. According to a recent note, WWE would need to complete media rights negotiations before a sale could be considered “sense” for any bidder, since its television deal expires next year.

After spending seven months away from the company amid a sexual misconduct scandal, McMahon announced last Thursday he would return as executive chairman of the company’s board.

According to Loop Capital’s Alan Gould, McMahon had been integral to every aspect of the business, which made it logical to run a parallel sale and licensing of US media rights starting in April. This is particularly important given the high value of sports and live entertainment rights across the industry.

As most likely WWE buyers, the analyst listed Comcast, Amazon, Netflix, Disney, Fox Corporation, and UFC parent Endeavor, all of which are more content-oriented than the Saudi Public Investment Fund.

On Friday, Gould raised WWE’s price target from $90 to $105 on the optimism of the sale, while Citigroup raised its target from $86 to $110 on Tuesday, each indicating a 15% upward swing.

Last week WWE announced that it will be undertaking a review of its strategic alternatives in order to maximise shareholder value. Reports by CNBC on Saturday claimed that the firm had enlisted JPMorgan Chase to help facilitate the process. No comment was made by WWE nor the Public Investment Fund when asked by Forbes. In June, Vince McMahon resigned as CEO and Chairman of WWE, and in July it was revealed he had paid millions in “hush” payments to past employees alleging sexual misconduct. On Tuesday Mr McMahon became Chairman once again, while his daughter Stephanie declared her resignation from her position as Co-CEO and Chairwoman, calling it “a personal decision”. The Saudi Arabian sovereign wealth fund caused uproar in 2022 with their investment into LIV Golf; offering generous rewards for top American golfers such as Phil Mickelson and Bryson DeChambeau.

According to Forbes, at the time of his June resignation, McMahon’s fortune stood at $2.3 billion, but it has grown substantially since then to $2.9 billion.

Also Read:

3 Comments