In Jun’23, the rupee rose 0.8% due to foreign portfolio investors inflows and a weaker dollar. Oil prices remaining range-bound also helped provide some reassurance. Given moderation in US core personal consumption expenditure and consumer spending, there is uncertainty around the Federal Reserve’s future rate policy which led to a decrease in the US Dollar Index. Macroeconomic data such as Purchasing Managers Index, non-farm payrolls and consumer price index are expected to give clarity in the month ahead. We expect that INR will trade in a band of 81.5/$-82.5/$ with a positive inclination based on FPI inflows and oil prices being lower than usual.

The movement of global currencies in June 23

Most global currencies rose against the dollar in Jun’23, with few exceptions. Central banks’ rate actions and the dollar’s movement both had an influence on the foreign exchange markets. The Federal Reserve’s prognostications and remarks made by officials since the latest policy meeting were optimistic; however, a moderation in core PCE index and a surprising decrease in consumers’ spending indicate possible softer stance from the Fed. The US Dollar Index (DXY) fluctuated during Jun’23 but closed lower by 1.4%. This ongoing uncertainty has favored EM currencies, particularly Brazil’s Real (BRL) and South Africa’s Rand (ZAR), which experienced increases of 5.6% and 4.7%, respectively.

It was a month of divergent monetary policy across major central banks. While the Fed held rates steady, the ECB and BoE hiked their policy rates. Interestingly, while the ECB hiked policy rates by an expected 25bps, the BoE hiked policy rates unanticipatedly by 50bps.

According to comments from the ECB and the BoE, more rate hikes are on the way. Inflation in both the UK (May’23) and Germany (Jun’23) picked up unexpectedly, after having been on a downward trend for some time. GBP and EUR gained 2.1% as a result.

In the month of September, the BoJ remained steadfast on its commitment to ultra-dovish policy, resulting in a widening policy divergence between the Fed and the BoJ. Although the government pledged to support the currency from further weakness, the JPY depreciated 3.4% during the month. In Sep’22, when the exchange rate dropped below 145/$, the government stepped in and bought the currency.

Recent indicators have reinforced views of a patchy recovery necessitating monetary and fiscal stimulus in the wake of Jun’23’s CNY depreciation.

What was the performance of INR?

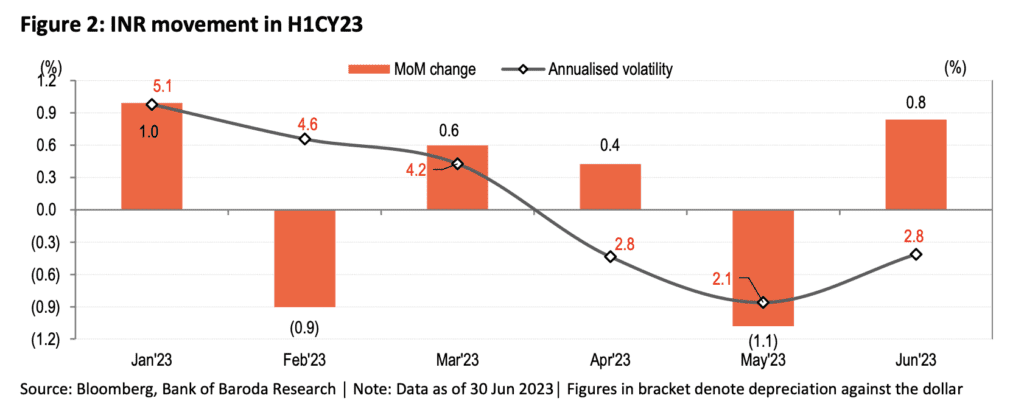

INR gained 0.8% in Jun’23, its biggest leap since Jan’23 when it rose 1%. This increase came after a 1.1% decline in May’23. It also resisted the depreciation of CNY which dropped 2% in the same month. In terms of volatility, INR stayed as one of the least unstable currencies having an annualized daily volatility at 2.8%, slightly higher than 2.1% last month. As compared to other 19 currencies observed, the median volatility was 6.8%. Emerging market nations showed less volatility while progressed ones evinced heightened fluctuations in Jun’23.

The strongest factor supporting the INR was buoyant FPI inflows. FPI equity flows in recent times have been driven by India’s strong macroeconomics, combined with a weaker dollar and lower oil prices.

INR outlook

We foresee INR appreciation in the future, as FPI inflows for India remain strong due to its status as the quickest-growing economy. While global economic growth has been threatened by various risks, oil expenses have stayed within a limited area. Additionally, China’s lack of growth is adding further pressure to oil values. India’s Current Account Deficit was reduced last month due to an abatement in trade deficit and prices for international commodity goods are expected to continue dropping which will result in a reduction of CAD this fiscal year; this is beneficial for INR in the mid-term and long-term.

INR is exposed to the possibility of a stronger dollar, due to the Federal Reserve’s assertive rate stance. The Fed and markets both anticipate two additional rate hikes by end-2019, with an 80% chance of a rise in July this year. Rate cuts are out of the equation right now. However, there is still considerable uncertainty surrounding the Fed’s decisions going forward, preventing DXY from any major change in recent days. Incoming data will be crucial in determining what path DXY takes next; for now, the direction seems unclear.

RBI’s foreign exchange reserves look robust at US$ 593.2bn, so INR is likely to weather market volatility without any harsh swings on either side. USD/INR NSE futures are priced in a range of 81.85/$-81.9/$ in July’23. During the next two weeks, we expect INR to remain strong, trading between 81.5/$ and 82.5$.

Read Also: