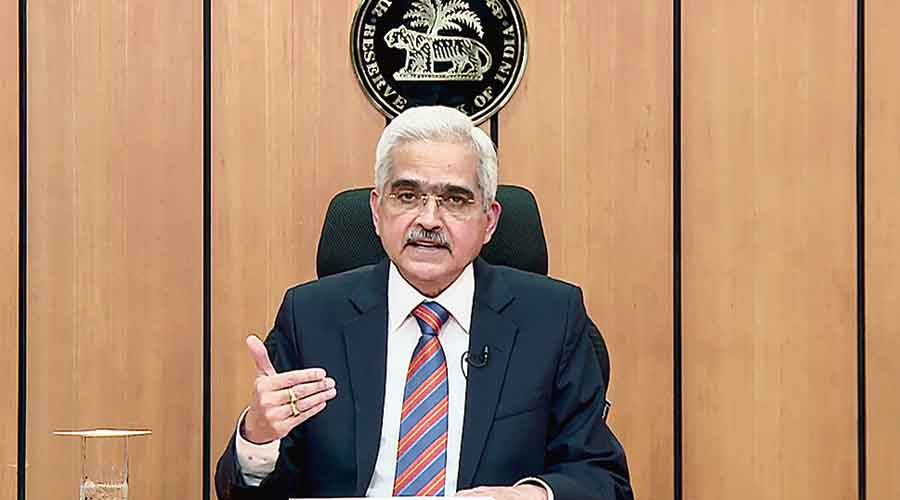

Despite heightened uncertainties and formidable headwinds, RBI Reserve Bank Governor Shaktikanta Das said Wednesday that the Indian economy has made a solid recovery and is among the fastest-growing large economies. All stakeholders in the financial system must work to maintain financial stability at all times, he said.

Despite potential and emerging challenges, the Reserve Bank and other financial regulators remain committed to safeguarding financial stability, As per RBI Governor Shaktikanta Das.

Amid this fragile global environment, balancing policy trade-offs, maintaining macroeconomic and financial stability, boosting confidence, and supporting sustainable growth are top priorities for policymakers.

In the last three years, the global economy has experienced successive shocks of high amplitude: the COVID-19 pandemic waves; protracted geopolitical hostilities; and rapid tightening of monetary policy.

The fragmentation of the economy is threatening macroeconomic prospects, especially for emerging market and developing economies (EMDEs).

As a result of the banking turmoil in the US and Europe since early March 2023, the global and Indian financial systems have charted somewhat different trajectories since the last FSR in December 2022.

Silicon Valley Bank and Signature Bank collapsed earlier this year, followed by Credit Suisse bailing out Switzerland’s largest bank, UBS.

The global and Indian financial systems have charted somewhat different trajectories since the last issue of the FSR in December 2022, it said, while the global financial system has been affected by significant strains in the US and Europe since early March 2023 due to the banking turmoil.

Despite this, the Indian financial sector has been stable and resilient, as evidenced by sustained growth in bank credit, low levels of non-performing assets, and adequate capital and liquidity buffers.

He noted the strengthening of balance sheets in the banking and corporate sectors, resulting in a ‘twin balance sheet advantage’ for growth. As a result of technology and growing digitalisation, there are new opportunities for growth and financial inclusion as financial intermediation reaches and deepens.

According to him, recent banking turmoil in certain advanced economies (AEs) has necessitated reevaluation of global standards on financial sector regulation.

For India, both regulators and regulated entities need to stay the course with an unwavering commitment to ensuring a stable financial system despite international cooperation on these issues.

He said seeds of vulnerability often get sown during good times when risks are overlooked.

In addition to cyber risks and climate change, he emphasized the need for international cooperation and regulatory focus.

In several areas, India’s G20 presidency is seeking to improve multilateralism’s efficacy. This is reflected in India’s G20 theme: One Earth, One Family, One Future.

Also Read:

- MPC likely to keep pause button pressed when it comes to RBI’s monetary policy

- RBI Massive Increase in Gold Holdings over 17% to a whopping ₹2,30,734 crore

- How RBI’s Pause is Boosting Confidence in India’s Real Estate Sector and Driving Stock Prices Up

- The Indian banking sector is well regulated and well supervised: RBI Governor

4 Comments