Given the release of UCLA Anderson Forecast’s June 2023 report, experts have got a sigh of relief: The US economy is YET not in a recession. However, there is some caution which needs to be observed carefully. Considering that core inflation is coming down slowly, there is a possibility that Fed might continue to tighten monetary policy. Experts believe that an economic downturn might be in the offing.

However, the question is when it might take place, and how bad could it be? Some Americans say that an economic downturn could be as bad as the great financial crisis. Just to let our readers know, a recession means a period when GDP falls for 2 consecutive quarters. It will not be wrong to say that recession has been delayed, but not cancelled.

Some financial research firms believe there can be a “very, very mild” recession in US economy. This can happen in the 4Q of this year or 1Q of next year. For now, such firms are of the view that it might take place in fourth quarter. However, greater clarity can be provided if experts know how strong the slowdown in employment is going to be.

On July 7, new jobs numbers exhibited that creation of private jobs in June touched lowest level since December 2020. Non-farm payrolls saw a rise of 209,000 in June, while the unemployment rate came in at 3.6% as per the U.S. Department of Labor. So far this year, the US economy has been able to create 85% of all the jobs which were created in 2019.

While there is a heated argument about the occurrence of US recession, there are experts believing that a recession has already started. According to Mr. Dhaval Joshi, BCA Research’s chief strategist, a typical world recession might have already started. He has enough data to back his arguments. The global economy is in a recession as the global GDP growth rate is at 1.2% as per data from the Oxford Economics nowcast.

Anything lower than 2% growth should be enough to qualify as the global recession. This holds true even though there is no outright decline. Mr. Joshi believes that the average growth rate for the global economy has been hovering ~2%. Now, anything below that number will mean that the world economy has been performing lower than average.

If facts are to be believed, the world economy never sees a full-fledged decline. This has taken place thrice over last hundred years- The Great Depression, the Great Recession, the COVID-19 pandemic. Economic data from the world’s leading economies seems to back up his thesis. GDP growth of France came in at 0.7% this year, while South Korea saw 1.5% growth, as per data from the International Monetary Fund. The U.S., world’s largest economy, saw 5.4% GDP growth in comparison to 2019 end.

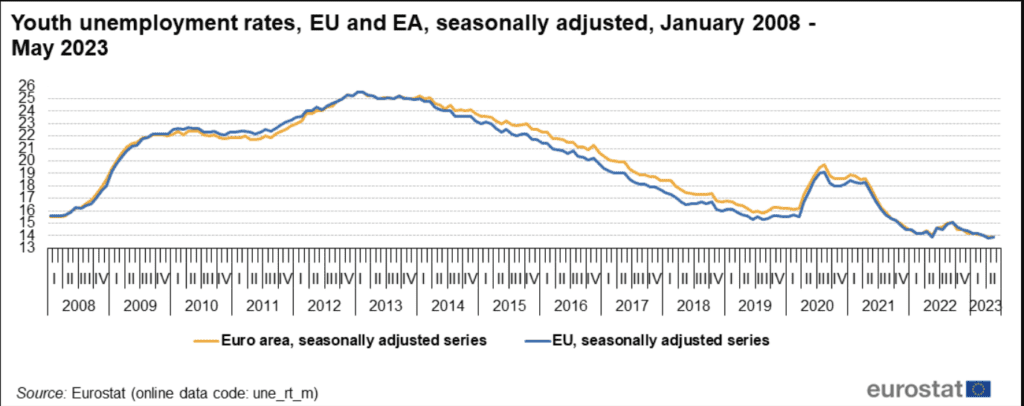

Businesses think tank, The Conference Board, believes that at times domestic and global recessions might not coincide. This is because individual countries can experience different economic outcomes as compared to the world as a whole. That being said, a critical factor experts have noted is the increasing unemployment rate globally. To start with, China’s unemployment rate of 20% for young people between the age group of 16- 24 supports lagging economic opportunity. This problem was seen in the European Union. Here, youth unemployment came in at 13.9% in May.

Yet this time again, the U.S. can be considered as an outlier with unemployment rate of 3.5%. We want our readers to know that youth unemployment can be used as an indicator for future social mobility along with consumer spending. This is because when people join workforce, this helps in increasing disposable income.

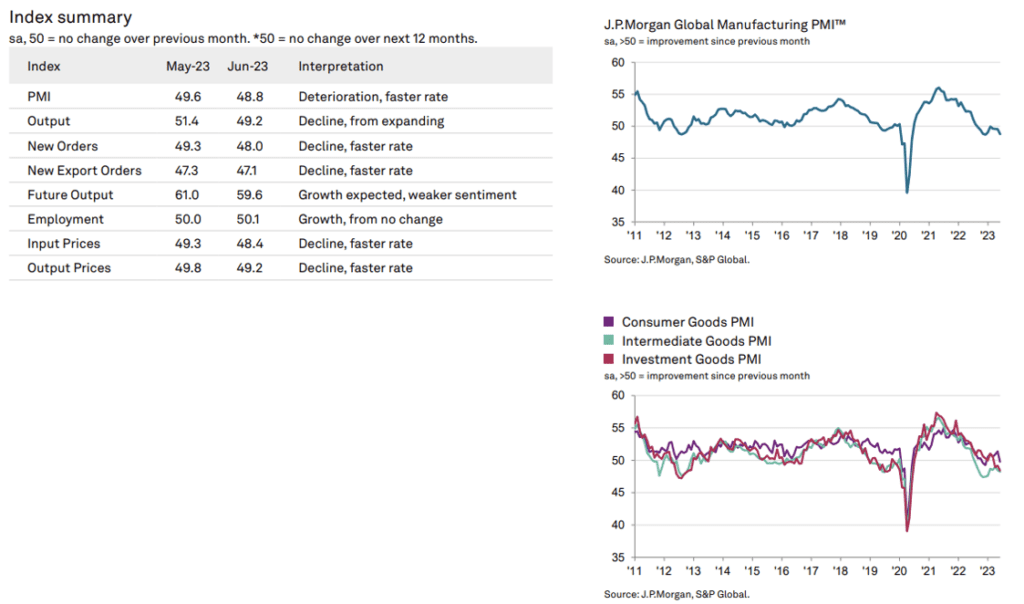

J.P. Morgan global manufacturing PMI is another metric global financial experts pay attention to. This helps in measuring global manufacturing output. This has fallen to 48.8 last month, and was the lowest number reported in previous 6 months. Fall in global manufacturing was primarily because of lower new order intakes. This means that demand for new goods remained subdued globally. That pattern has continued for 12 consecutive months, according to data from S&P Global.

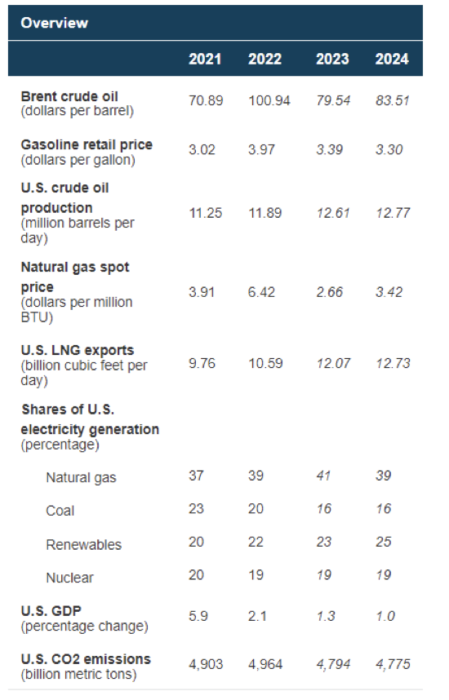

Despite strong performance of stock market, other sectors have seen the brunt of the challenging results from the manufacturing industry. Brent crude oil prices fell and came in at $79.54 a barrel this year from $100.94 in the year ago, as per U.S. Energy Information Association.

Source: US Energy Information Administration

Experts believe that the US Fed and the central banks throughout Europe might exacerbate the problem as and when policies tighten. Even though the US Fed opted against another rate increase in June, recent minutes released exhibit that idea was debated among the policymakers. Therefore, more actions might be in the offing.

Read Also:

- Indian Economy Outshines Global Headwinds: Insight from RBI Governor Shaktikanta Das

- Russia’s Economy at Risk: How Fighting Beyond Ukraine is Impacting Business

- How the Decline of Workplace Efficiency is Affecting the Global Economy

- How Indian Tech Firms Are Contributing An Insane Amount To The US Economy

2 Comments