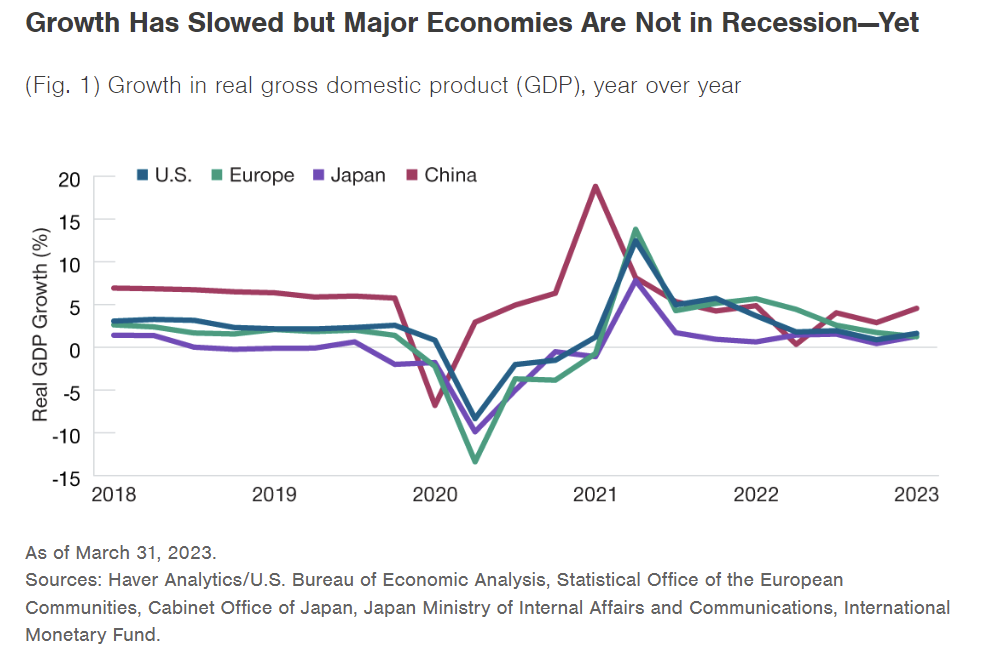

Global economy has, somehow, avoided recession in 1H23. However, global asset managers continue to expect that 2H is expected to bring more tests on account of higher interest rates and tighter liquidity. Investors are required to think twice before they jump into long-term U.S. bonds. Credit sectors and global ex-U.S. markets are expected to provide return potential. Earnings estimates are required to fall further. However, there are a range of opportunities in US small-cap stocks, mega-cap technology, and global markets.

Moving into 2H23, several other economic forces appear to be tilted against global capital markets. Sticky inflation, tightening by central banks and financial instability continue to pose clear risks. However, through late May, economies and markets both have exhibited resilience. Growth was positive in major economies and results of several companies came in stronger than expectations. Key equity markets ended up in gains.

Such results seem to validate wisdom of “reluctantly bearish” approach. Bearish- since there are huge number of risks and reluctant- because excessive pessimism can make investors overlook opportunities and miss recoveries in equity market. Therefore, this question is still up for a debate that whether economies and markets can defy pessimists in 2H. There are a range of indicators which continue to flash red. However, some distortions from COVID-19 pandemic make it hard to spot signal from noise. That is to say identifying useful information from meaningless data points.

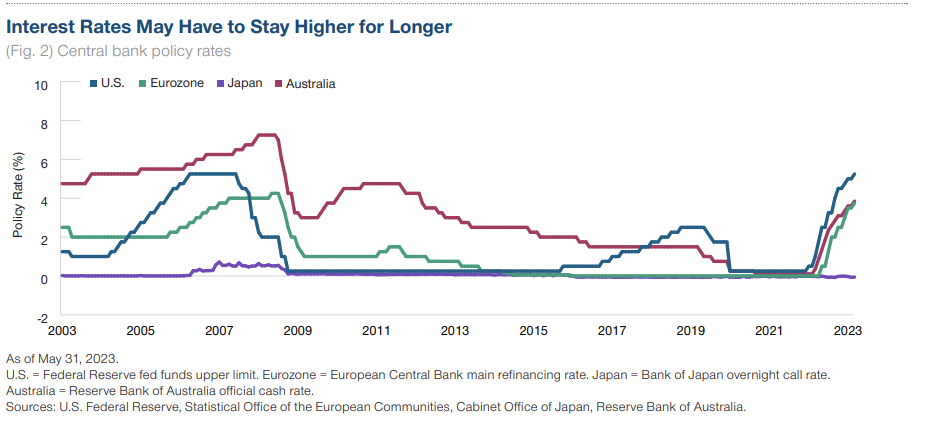

Strongest bear argument according to experts is that the economic impact of 500 bps of interest rate hikes by the central bank of U.S. has yet to be felt fully. Despite of the fact that US banking crisis seems to be contained, its impact on credit conditions will have a negative impact. Resolution of political dispute regarding the U.S. debt ceiling might squeeze market liquidity in 2H as the U.S. Treasury reconstructs its depleted cash account at the Fed.

That being said, the opportunities can be capitalised in certain sectors, such as small‑cap stocks and high yield bonds. Lower valuations along with the weaker U.S. dollar might make global ex‑U.S. equity markets attractive. Positive yield curves might do the same for global ex‑U.S. bond markets. In such an uncertain economic environment, carefully selecting the security is expected to be critical. Therefore, skilled active management should investors avoid taking riskier exposures.

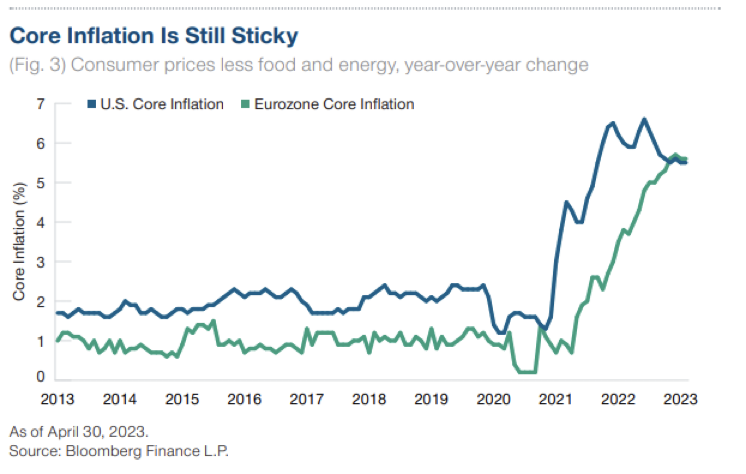

Inflation remains a concern

Sustained inflationary pressures is the main global obstacle when it comes to monetary easing. Core inflation readings—excluding fluctuating food and energy prices—is stubbornly high. Service sector inflation continues to move up and another energy price shock is still a risk, mainly for Europe.

Experts believe that the U.S. inflation might get stuck at ~3%, maybe even ~4%, for a while. Now, a 4% rate will actually be double than the US Fed’s target. U.S. Treasury should issue an estimated USD 1.4 trillion in debt in 2H to cover deferred payments and to do some restoration of cash reserves.

Expectations on earnings

More or less, equity returns were positive during the initial 5 months of 2023. Experts now question that whether or not earnings forecasts, that stabilized in first part of the year, will turn down again. As of late May, growth expectations for 2024 earnings for the companies available in S&P 500 Index were still in double digits.

We all know that Wall Street analysts tend to be optimistic when predicting earnings, but experts believe that such expectations should come down.

Assuming that the global economy enters a mild recession, 2024 global earnings might be flat or down 5%. In comparison to the previous earnings cycles, this can be viewed as the bullish outcome. If there is a modest earnings decline, even that will put further pressure on the stretched U.S. largecap valuations.

Conclusion

Entering 2023, experts argued that tension of the deep global economic downturn were exaggerated. Pessimism might end up creating contrarian opportunities. As of late May, both the propositions seemed to be correct—1) Recessions in the U.S. and Europe, which was predicted when the year started, had yet to materialize, 2) Big and renowned equity markets in the US, the eurozone, and Japan exhibited positive YTD returns, and 3) Default rates were low, helping strong returns on high-yield bonds.

Now, there are expectations that there will be a global recession starting later this year or in early 2024. However, the recession is expected to be mild. Because of the list of economic and financial paradoxes, it is difficult to estimate the risks.

On the positive note, the resolution of the US debt ceiling dispute has prevented one potential crisis. However, it can tighten the liquidity in 2H. Lower unemployment supports in creating consumer demand, which is a big positive for earnings. But, it is negative for the inflation and interest rates. Reflation in Japan can be considered as good news but this can lead the BoJ to decontrol yields. This will be the bad news for several other international markets.

There are some asset managers maintaining a positive view on Chinese equities even though there are some structural economic issues going on in the country. Growth in money supply in China presently outstripping the real economic growth. When in normal circumstances, this is a strong backdrop for financial asset prices.

However, now, investors should be mindful of the geopolitical risks which are lingering—primarily the potential for the conflict over Taiwan.

While there are several risks which can impact the equity markets in the 2H, experts believe there are some pockets of opportunities. Therefore, investors should go for diversification.

Read Also:

- How the Decline of Workplace Efficiency is Affecting the Global Economy

- Indian Economy Outshines Global Headwinds: Insight from RBI Governor Shaktikanta Das

- What’s in store for the US economy? A recession? Let’s have a look at few parameters!

- Global economic growth to drop 4.4% after slowdown in U.S. and China: report

1 Comment