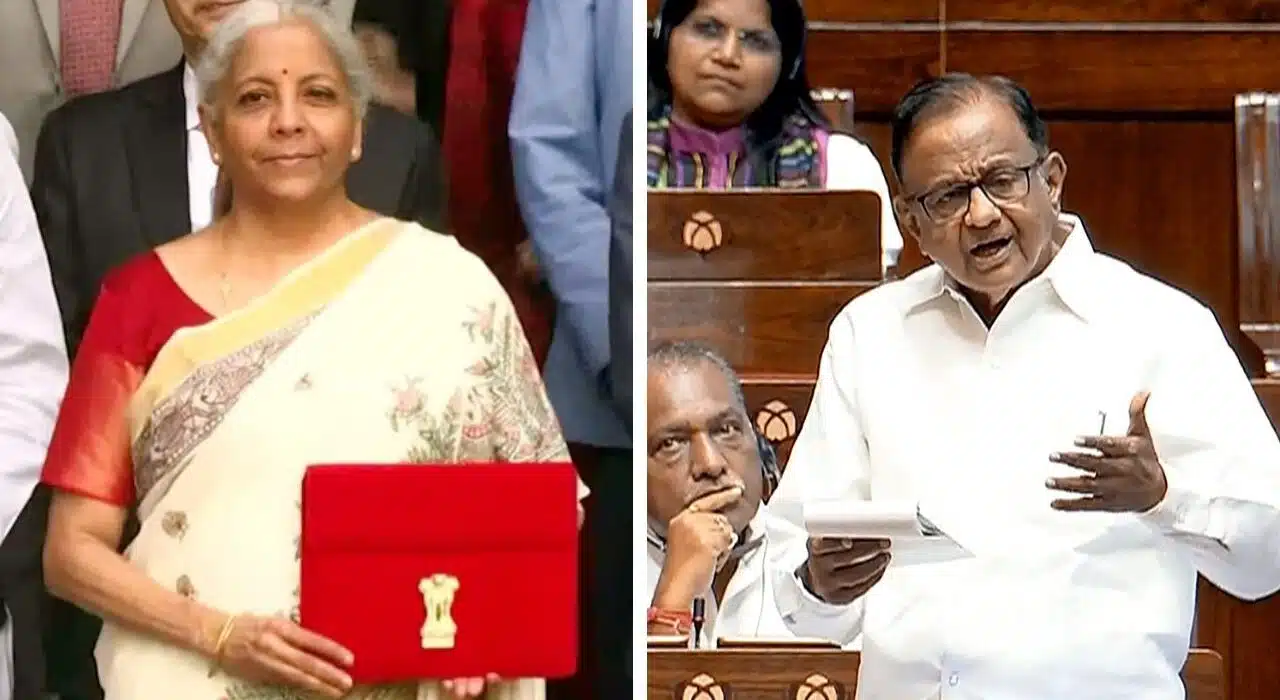

The Finance Ex-Minister, Chidambaram, Slams Sitharaman and questions the Union Budget 2025. He accuse BJP government to select voter bases and neglects the economic concerns. The former Finance Minister P Chidambaram address the press conference post-Budget, and make announcements of “pre-election pitch”. This announcement on Budget 2025 Chidambaram Slams Sitharaman aimed at the Bihar electorate and Middle-class people.

According to the Budget 2025 takeaway, BJP is wooing the tax-paying middle class and the Bihar electorate. This announcement released for the 3.2 crore tax-paying middle class and the 7.65 crore voters of Bihar. Congress leader also pointed to the financial performance of the current year 2024-2 and marks the cut of ₹1.04 lakh crore in total expenditure. It also highlights the ₹92,682 crore in capital expenditure involved in crucial factors, such as rural development, education, health, social welfare, etc, he said in the press.

Budget 2025 Chidambaram Slams Sitharaman: A Relief for Indian Middle Class

Nirmala Sitharaman exempts the income of up to ₹12 lakh from rejigged tax slabs and income tax slabs. He said, “ I am happy to announce that there will no tax payable up to 12 lakh annual income. This announcement released under the new regime.

On this, Sitharaman said that, “ The new structure will reduce the taxes of middle class and leave money in hands. It boosts household consumption, investments, and savings.

Related: Union Budget 2025: Expect prices hike for everyday essentials!

Tax Applicable As per Union Budget 2025

According to Rejig, people having an annual income of 12 lakhs will need to pay nil tax up to 4 lakhs, 5% for income range between 4-8 lakh, 10% for income range between 8-12 lakh, 15% for income range between 12-16 lakh.

As per Budget 2025 Chidambaram Slams Sitharaman, the 20% income tax is applicable to individuals who earn annual income between 16-20 lakh, 25% for income between 20-24lakh, and 30% for income between 24 lakh per annum.

Read also: Senior Congress Leader Shashi Tharoor Criticizes Union Budget, Raises Concerns Over Unemployment